The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 0.58% in January, compared to 6.28% for the S&P 500 Index. LBAY paid our twenty-sixth consecutive monthly distribution, at $0.075 per share in January. This is a 2.26% SEC yield versus the S&P 500 Index dividend yield of approximately 1.66%, and the 10-Year US Treasury yield of 3.511%. Year to date as of January 31, 2023, NAV for the Fund has returned 0.58%, compared to 6.28% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 57.24% cumulative total return and a 22.75% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

THE RETURN OF THE MEME

To kick off the year, we find ourselves asking if twenty-three rhymes with twenty-one. The first few months may feel similar, but we doubt the next few quarters will reflect the rally experienced throughout 2021.

We do not think the story has changed; we believe we are re-reading the middle chapters of the same book. The US Federal Reserve Board (the Fed) continues to guide markets that interest rates need to continue their path higher while preparing for the possibility that they will remain elevated for a longer period of time. We see what we suppose are the same type of market dynamics that existed through the “meme-stock craze” in 2021. Many companies that we find fundamentally weak have enjoyed surging share prices to start the year. Have the growth prospects of these companies materially improved? Has some overlooked value been suddenly unlocked in these names? Or, perhaps, is it simply market participants chasing the optimism that the Fed will shift policy back to the glory days of “free” money?

We look back to our August 2022 insight, and wonder again if we are in the midst of another rally on the way down to lower levels. The management teams that maintained enthusiasm about improving status quo during the last earnings cycle seem to be less confident during the release of the most recent number prints. Borrowing costs are in fact higher, and inflation is unfortunately still a word rattling through the minds of most consumers. We are hearing the term “trading down” used quite a bit when referencing consumer spend. The calculus for the growth that we see currently being priced into many stock prices does not equate, in our opinion, to the amount of dollars available in the pockets of many Americans.

“While the consumer may not have cut back on total dollar amounts spent, we think they are buying less quantities of the goods and services that have allowed many companies to report results that were not ‘as bad as feared’.” – Leatherback Asset Management, August 2022

THE TWO E'S

Earnings and Employment. We think these are the key drivers that will determine the path the market will take next. For us, the signal in the noise this time around is an echoing mantra; revenue beats, earnings and margins miss. We continue to wonder how long it will go unnoticed that the bar on profitability and performance metric outlooks continues to be lowered.

On the one hand, earnings and margins appear to be contracting. The cost of profitability is wrenching higher. On the other, the Fed is telling the public job losses are “needed”, and to be prepared to expect them. In other words, broader prices cannot revert to longer-term inflation targets if workers continue to expect and command higher wages (enter the debate on wage-price spiral). Given these undercurrents, we think share price multiples may resume a trend down.

“Despite the slowdown in growth, the labor market remains extremely tight, with the unemployment rate at a 50-year low, job vacancies still very high, and wage growth elevated…, the labor market continues to be out of balance.” – Fed Chair Jerome Powell, February 1, 2023

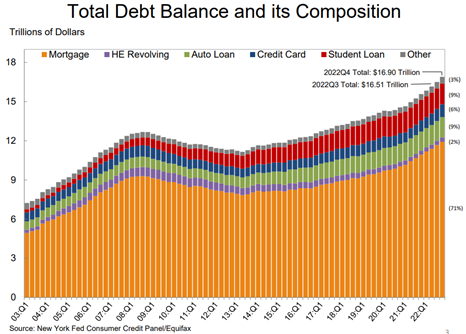

Notably, household debt has been marching higher. In the last few months, household debt hit a record $16.9 trillion, led by mortgage debt which hit a record $11.9 trillion. Additionally, auto loans continue the march to higher all-time highs and student loan debt hit an all-time high of $1.6 trillion. Credit card debt also hit another new all-time high of $986 billion3. Employment needs to remain ebullient to enable consumers to service these all-time high debt loads.

PORTFOLIO UPDATE4*

We recently initiated a position in Waste Management, Inc. (WM), the largest waste collector in the US with just under $20B in revenues and a market capitalization of approximately $60B. We are intrigued by the waste collection business as we think it provides recession-resilient recurring revenues with strong and consistent free cash flow. WM has a long history of shareholder-friendly capital allocation as the company has increased its dividend annually for nineteen consecutive years. WM has bought back roughly $2B in share repurchases as well. The stock has fallen over the last several months and now trades at the low end of its longer-term price to earnings multiple range. Given our view that recession risk is elevated in 2023 or 2024, we find WM a compelling long position in today’s environment.

On the short side of the book, we have had several higher beta, low quality positions rally significantly to begin 2023. We maintain short exposure across most of these names but have risk-managed the positions by reigning them within a target of approximately 2% level exposure limits. We believe the market set up is very rewarding for the remainder of 2023 as many low quality, high valuation names have re-rated higher providing a nice set-up on the short side.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners enjoy our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

Sentiment still seems pretty frothy to me. We have stocks doubling again in the month of January, retail volume in the NYSE as a percentage of total volume hit a record two weeks ago, and you have record volume in zero days to expiration options which is basically gambling. Tesla trades more options every day now than the S&P 500 and Apple. I’m not sure speculation is gone.” – Jim Chanos

*Definitions: Cash flow is the net amount of cash generated by a company, with cash received as an inflow, and cash spent as an outflow. Free cash flow is the cash available after paying operating expenses. Beta is the percent change in the price of the security given a 1% change in the market index

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: https://www.newyorkfed.org/, February 2023

4 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Section Source: Bloomberg unless otherwise noted.

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner