The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) NAV advanced by 10.18% in December, compared to an advance of 4.48% for the S&P 500 Index. LBAY paid our thirteenth consecutive monthly distribution, at $0.065 per share in December. This is a 3.20% SEC yield versus the S&P 500 Index dividend yield of approximately 1.27%, and the 10-Year US Treasury yield of approximately 1.51%. Year to date as of December 31, 2021, NAV for the Fund has returned 22.39%, compared to 28.71% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 27.73% cumulative total return and a 24.34% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.43%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

We believe 2022 will be ripe for stock picking. We think fundamentals matter, and the opportunities that are available may lead to 2022 being an alpha-generating year for short selling. After a decade plus of Central Bank accommodation and a year and a half of unprecedented stimulus, the Federal Reserve is finding its inflationary hand is being forced - Global Central Banks will be reducing stimulus. The rotation out of growth factors and into value stocks has been taking place for the last several months. We think this may only be the beginning. Last year, the consensus was very hesitant to pound the table on inflation, simply because every call for it over the last decade had been wrong. We think there is a rhyme here and suspect the market may reluctantly bring value stocks back into favor.

“We think it’s firing on all cylinders now…The fundamentals are right, the price momentum is right and the valuation spreads are still, ignoring the prior six months, at records3.” - Cliff Asness

A year ago, the meme stock craze was at its height, and many allocators swore off short-selling and many of those that ran short “books” may have sought refuge within index hugging ETFs. As we wrote at that time, we thought that would prove to be a mistake.

“One could argue we need short sellers now perhaps more than ever.” - Leatherback Asset Management, February 23, 2021

There appears to be more and more evidence pointing to the highly accommodative fiscal and monetary policies as being the major contributor that facilitated an ebullient market environment for risk taking. Is this unprecedented government spending the driver of what is being called economic growth?

“If you go back four decades of stock market data, there are many valuation metrics that are in the top 1 percentile of overvaluation. So, the thing that’s keeping it going, of course, is the Fed with rates at zero and promises to stay at zero,…[this] allows for valuations to be record-breakingly high.4” - Jeffrey Gundlach

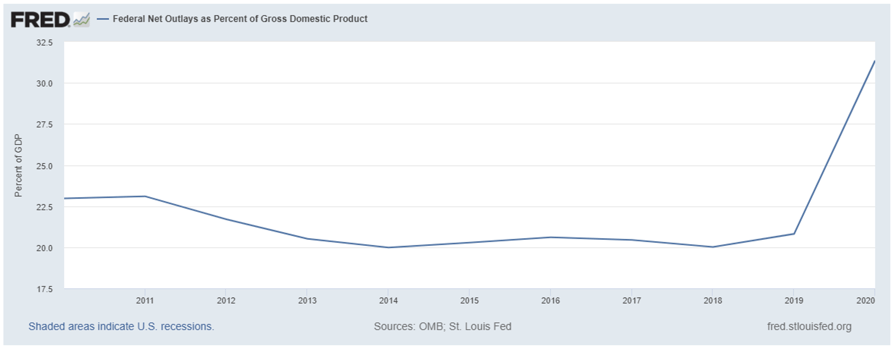

The visual representation below showing the latest data of the non-seasonally adjusted contribution of these government outlays through January 1st of 2020 is rather striking5. With the possibility of an environment that may continue to see a further rise in interest rates, along with anticipation of imminent tapering, we may soon get an answer to the above question on growth drivers. Given this, we expect choppier markets during 2022 and think we will see volatility across sectors, both of which may provide security specific dislocations.

THE MINUTES

The tape looks like it is responding to what the Federal Open Market Committee is saying it will do next. The minutes of the December meeting were released in the first week of January, and it appears market watchers are viewing details in the minutes as a bit more hawkish than the message delivered to reporters after the meeting in mid-December. Later in the week, jobs numbers were released, with the overall top line number missing estimates for the increase in month over month jobs. Interestingly, the labor force participation rate was all but unchanged, the unemployment rate fell below 4% (a number that hasn’t been breached since the economic shut-down in early 2020), and hourly earnings were hotter than expected. We pointed to some questions during the second and third quarters of 2021, which appear to continue to perplex policymakers, that we may now be seeing the answers to. Are there less workers, with more of those workers already employed, and requiring higher levels of pay to do the job?

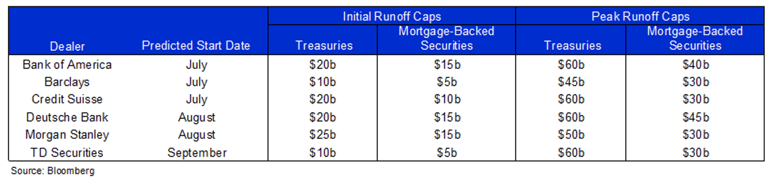

We pointed to the challenge and timing of balance sheet reduction in our last installment, and it appears that the market was surprised to see the minutes reflective of internal Fed discussions about a possible decrease. Below is a summary of dealer views on the possible path for the runoff 6:

What does this mean? Maybe there was a disbelief that the Fed needed to, would or could take any of the three actions of tapering, hiking, or running off the balance sheet with “quantitative tightening”. Short and intermediate US Treasury yields have adjusted higher in response as we write this piece, with yields out through the 10-year touching the highest levels since pre-pandemic. It remains to be seen if the rates complex takes another leg higher, and how markets respond, but maybe the perceived “Fed Put” is through the recent lows.

What does this mean for asset markets? No matter what the answer is, we think there are opportunities to explore, and we look forward to continuing our dialogue in the weeks and months ahead.

PORTFOLIO UPDATE7

We are finding many compelling ideas both long and short in the current market landscape. First, we have been adding long exposure to Zimmer Biomet Holdings Inc (ZBH), a leading medical equipment manufacturer that generates significant revenues from knee and hip replacement products. In our opinion, sentiment will shift positively as the cadence of the year 2022 plays out and investors begin to look past the tepid, yet temporary, fundamental business headwinds as elective surgical procedures have decreased dramatically due to persistent COVID-19-related issues. We do not think the longer-term secular demand for replacement hips and knees is declining and expect a return coming out of the pandemic as elective surgeries normalize. Additionally, ZBH announced intent early last year to spin off its spine and dental businesses as ZimVie. We have made ZBH a top ten position in our portfolio, and we believe there may be substantial upside potential from its December 52-week low stock price.

Next, we look to Carvana Co (CVNA), which we first discussed in our August insight. CVNA remains a core short for the Fund, and we believe the stock may continue its downtrend that began in the third quarter of last year. Carvana markets itself as an e-commerce disruptor and online platform for used cars. Yet, we believe the company’s business is fully reliant on the asset-backed securities market as they package subprime used car loans and sell them into the securitization market. Much of their reported gross profit per unit (per car) is generated from the gain on sale of loans packaged into securities. We think both the underwriting of the loans to subprime borrowers as well as the collateral itself may prove fleeting as the tranches of securities season. If the securitization market seizes, or even becomes less thrilled about the used car loan collateral, we believe CVNA could see more downside pressure on its stock price.

Lastly, we think consumer discretionary stocks broadly may have a challenging set up as stimulus has been removed and inflationary pressures persist, leaving less pocket money for many optional purchases. We recently added a new short position in Lululemon Athletica Inc (LULU), where we think the valuation may be more stretched than the pants.

FINAL THOUGHTS

Leatherback is thankful for those that have entrusted us. Our goal has been to provide institutional quality long/short investing alternatives to the masses in a fully transparent, and potentially tax efficient ETF**. As we enter the new year, we hope you consider us for an allocation in 2022 and beyond.

"

I believe starting a company is like jumping off a cliff and assembling a plane on the way down -- your willingness to jump is your most valuable asset as an entrepreneur.” - Reid Hoffman"

* Alpha-generating refers to a strategy that seeks to generate excess returns or value without additional risk.

** In general, ETFs can be tax efficient. ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: https://bloomberg.com/

4 Source: https://cnbc.com/

5 Source: https://fred.stlouisfed.org/

6Source: Bloomberg

7 View LBAY top 10 holdings here. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner