Big Oil, big challenges, and a big new name joins Exxon’s board. With the announcement of Jeff Ubben joining the board of Exxon Mobil Corporation, we find ourselves more bullish on the company than we’ve been in some time.

You can teach an old dog new tricks, if it wants to learn. One of the oldest “dogs” out there, Exxon Mobil Corporation (XOM), just made a move that indicates a willingness to learn and change and, hopefully, innovate and grow. The company has announced that it will be adding Jeffrey Ubben, founder of Inclusive Capital Partners, and one of the most respected activist investors, to its Board. Ubben, who in June of last year left his $16B hedge fund ValueAct after twenty years at the helm, founded Inclusive Capital Partners with a mission to become an impact-focused activist aimed at older legacy companies that “are in the problem, that really need to be part of the solution.”

This was a move first rumored at the start of the year, and at the time we applauded the thinking. Now, as it becomes a reality, we are intrigued and even more bullish on XOM, having reflected on all that Ubben has accomplished at ValueAct, perhaps most notably with Microsoft Corp (MSFT).

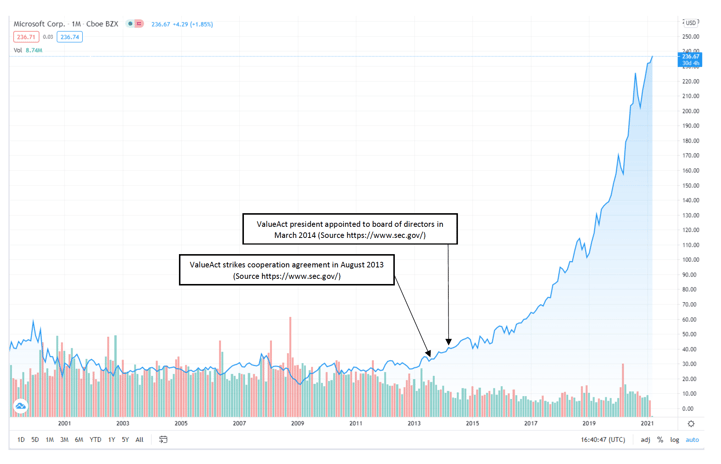

It’s easy to forget now, but for more than a decade, Microsoft’s stock languished. From 2000 through 2013, MSFT stock did nothing, literally nothing. The stock closed out the year 2001 at $33 per share; at the end of the year 2012, the stock sat at $26.70.

While Apple Inc (AAPL), Amazon.com Inc (AMZN), Alphabet Inc (GOOGL) and several other big tech names were generating all the buzz, out-innovating and out-marketing the company, Microsoft was in serious danger of becoming a technological backwater. Enter ValueAct. After striking a deal in August of 2013 with Microsoft’s Board to engage its directors and management to have an open dialogue, Microsoft offered ValueAct’s Mason Morfit a Board seat in March of 2014. ValueAct led a turnaround for the ages, and Microsoft, in both reputation and results, has been enjoying a run these past several years that few companies, and shareholders, get to experience.

Is Exxon Mobil perhaps a bigger challenge? In many ways, yes. Jeffrey Ubben has stated publicly that he believes oil and gas companies should be included in the list of sustainable companies. In an investment his firm made in BP Plc (BP), he has stated that BP has the necessary infrastructure, resources, workforce, geologists and expertise to move to the cleaner solution.

There may be bright spots on the horizon for oil in general, tied as it is so closely to the reopening trade. But we still have a company here that is one of the world’s worst polluters, during a time when investors are clearly punishing (and rewarding) companies through an ESG lens. But it would be a mistake to overemphasize ESG factors when thinking about a possible Exxon turnaround story, especially with Ubben now involved.

Yes, there could be some halo effect for Exxon’s continued efforts to diversify its energy generating approaches into cleaner categories like wind, geothermal and solar. But beyond the E, the S, or the G, there are opportunities for more effective capital allocation, an area where Ubben is one of the best in the business. Expect the full range of options to be on the table: spin-offs, divestitures, acquisitions, and the importing of new talent in senior leadership positions to better drive the company into the future.

Exxon may not hit the bullseye with every move, but there is enough low hanging fruit when it comes to the Exxon story that even just a few meaningful moves in relatively short order should spur significant performance improvements, all of which will benefit shareholders, unlocking meaningful yields.

Just last year, we were talking about Exxon in the context of being removed from the Dow after 92 years. “The beginning of the end” for Big Oil screamed more than one headline. But from where we were sitting, it remained a mistake to write off some of the biggest names in the energy sector; and with Jeff Ubben joining the board at Exxon, we’re more bullish on that name in particular than we’ve been in some time.

Disclosure (We are long XOM). See our full list of holdings here.

"

...oil and gas companies should be included in the list of sustainable companies."

Source data for the Microsoft Corp. chart can be found here: https://www.tradingview.com/chart/?symbol=NASDAQ%3AMSFT

Corporation Info: https://www.sec.gov/Archives/edgar/data/789019/000119312513354149/d592198dex991.htm

Board Info: https://www.sec.gov/Archives/edgar/data/789019/000119312514094551/d691442dex991.htm

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner