The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) declined by 1.44% in September, compared to a decline of 4.77% for the S&P 500 Index. LBAY paid its thirty-fourth consecutive monthly distribution, at $0.075 per share in September. This is a 2.31% SEC yield versus the S&P 500 Index dividend yield of approximately 1.61%, and the 10-Year US Treasury yield of 4.572%. Year to date as of September 30, 2023, NAV for the Fund has declined 9.97%, compared to an advance of 13.07% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 40.74% cumulative total return and a 12.64% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

FOR LONGER OR FOREVER

For well over a decade, US interest rates remained ultra-low. This created what many now view as an ideal environment for risk-taking. “Lower for longer” was the investing mantra from around 2008 through 2022. Government bonds and the safest fixed income instruments yielded next to nothing, while long duration* equities outperformed broad markets. In response to rampant global inflation, policymakers mandated an end to the party, and rates began to ratchet higher throughout the last year and a half.

“Inflation is like toothpaste. Once it’s out, you can hardly get it back in again. So the best thing is not to squeeze too hard on the tube.” — Dr. Karl Otto Pöhl

Market participants have been predicting inflation has peaked and that the worst may be behind us. As a result, we suppose an overoptimistic hope for rate cuts has sparked the US equity rally during the first half of 2023. As previously entrenched expectations are reluctantly reset and investors continue to digest the current market environment, we believe that long-term interest rates are sticky and are going to be here for a while. Given this, we think it is likely that equity market multiples will compress, and companies we find overvalued may suffer the consequences. Allocators may no longer need “bond proxy” equities, as bonds now maintain positive real yields. It is our thought that shareholder yield is likely to drive total return for equity investments. In our opinion, companies that are unprofitable and appear to require perpetual cheap capital are attractive short candidates. Finally, we envision absolute return long/short strategies are likely to outperform levered long* private and public equity investments.

BACK TO THE FUTURE

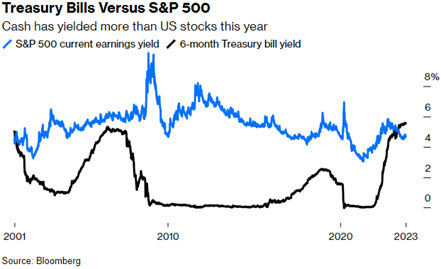

We are revisiting times that a good portion of current investors have either never experienced or may seem too long ago to remember. It may also be a bit of a shock for savers that their money is finally yielding something tangible. “For the first time this century, cash pays a higher yield in interest than the S&P 500 does in earnings — and with cash you actually get the cold hard money in your hands, rather than relying on accountants to calculate corporate profits correctly.”3 We find the below visual impressive:

In an insight earlier this year, we discussed the concept of the magical 5% number on interest rates, and how this may sometimes be thought of as a psychological level for investors lending their cash at a perceived “attractive” rate. Shorter-term interest rates have seen this level for several months now, but interestingly the 10-year Treasury briefly touched the 5% yield level during the fourth week of October. It hasn’t breached this rate since 2007. The staggering speed with which interest rates have risen this year has likely introduced a level of volatility to the fixed-income world that few were expecting.

“Five percent is more or less the average of investment-grade rates since the time of Alexander Hamilton…The problem is the structures that 10 years of ultra-easy money brought about. People blame it on the normalization of rates. The previous bout of abnormal rates is the problem.”4 - James Grant, founder and editor of Grant’s Interest Rate Observer.

PORTFOLIO REVIEW5*

In our opinion, a new normalized environment of higher for longer interest rates is constructive for active management and fundamental long/short strategies. We believe shareholder yield, which is core to our strategy, will drive future total returns as stock multiple expansion could be more difficult to achieve. Our current portfolio reflects many long positions with what we think are below market multiples, healthy growth profiles and appealing shareholder yield. We highlight one current long position, Old Republic International Corporation (ORI), a $7.7B market cap specialty insurer that currently maintains a 3.6% dividend yield and has repurchased $756mn of its own stock (nearly 10%) since the 3rd quarter of 2022. We feel the company maintains a conservative, liquid investment portfolio and a newer management team that seems constructive with capital allocation. The company currently trades for a forward price to earnings multiple* of around 10x, has increased its dividend for 42 consecutive years, and we believe the company could be an attractive takeout candidate.

Next, we view the setup on the short side of the ledger as increasingly interesting. We are looking for unprofitable companies that have perpetually relied on easy access to cheap capital. Additionally, we continue to favor the consumer discretionary sector shorts thesis. As we have outlined in previous writings, we think the difficulty experienced by consumers to maintain elevated levels of spending is just getting started, as the consumer credit environment continues to evolve.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners enjoy our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

In the end, life is simple. Low rates push up asset prices. Higher rates push asset prices down…We’re now in an era that will average higher rates than we had for the last 10 years.” – Jeremy Grantham

*Definitions: Duration measures a bond's or fixed income portfolio's price sensitivity to interest rate changes. Levered long refers to an investment strategy that uses borrowed funds to finance long positions to increase potential returns. Earnings per Share Estimate is a company’s expected future annual earnings per share, as estimated by professional analysts. Forward Price to Earnings Multiple is the ratio for valuing a company that measures current share price divided by its forecasted earnings per share.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: https://www.bloomberg.com/, October 19, 2023, courtesy @jessefelder

4 Source: https://www.wsj.com/, October 26, 2023

5 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Section Sources: Bloomberg, https:// ir.oldrepublic.com/

Jeremy Grantham quote source: https://www.bloomberg.com/

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner