The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) declined by 2.44% in August, compared to a decline of 1.59% for the S&P 500 Index. LBAY paid its thirty-third consecutive monthly distribution, at $0.075 per share in August. This is a 2.06% SEC yield versus the S&P 500 Index dividend yield of approximately 1.54%, and the 10-Year US Treasury yield of 4.109%. Year to date as of August 31, 2023, NAV for the Fund has declined 8.66%, compared to an advance of 18.73% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 42.79% cumulative total return and a 13.62% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

JUST IN CASE

Over the past several decades, the world progressively “shrank”. Companies of all shapes and sizes, and more broadly, economies at large expedited a shift in scope from the full business cycle operating locally to a tilt toward an international scale. The phenomenon of globalization was here, and if you didn’t embrace it, you may as well have gotten out of the way. The view was if you didn’t get on board, you were in essence deciding to go out of business. Outsourcing and offshoring were terms popping up across many industries, and soon became ingrained corporate speak. This was a euphemism for firing part of the domestic workforce and sending jobs across borders. Just-in-time inventory became the rule to strive for, rather than the exception. This is the practice of keeping just enough inventory of items, or inputs to a product, on hand that are needed to fulfill orders ready to go out the door or when required for manufacture. Technological advances that we now take for granted made everyday occurrences out of what not long before seemed like impossibilities. The speed of communication, automation improvements, reduction in costs and delivery efficiency created an interconnected web on a macro scale. Global companies benefitted as corporate margins expanded while labor and manufacturing costs contracted.

The pandemic, which defined the start of the 2020’s decade, may have opened a Pandoras box and exposed how our global interconnectedness progressed to over-reliance on specific partners or locales. It becomes even more complex as we see trends emerge given varying degrees of nationalism and geopolitical protectionism. Most consumers are familiar with supply chain issues, which is where a good bit of the inflation blame is being placed. As companies and service providers have realized just-in-time inventory caused shortages, inefficiencies, and cost increases, many have switched to procuring larger amounts of inventory in an attempt to alleviate past supply headaches. Inventory is being managed at levels, “just in case.”

This implores the question: Is this experiment still working?

A RETURN TO SENDER

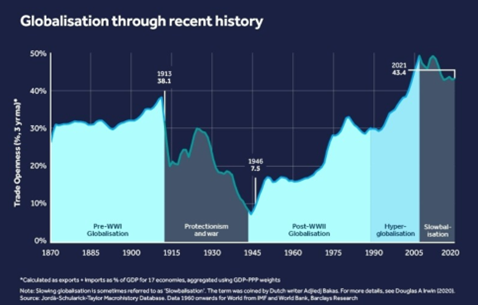

It is interesting to us that we appear to be in the midst of a shift back from “the hyper-globalization period from 1990 to 2008… to a period of relatively stagnant ‘slowbalisation’, [which] appears to be moving towards deglobalisation3.”

This could be an example: Maybe it started with the Sales team moving away from the Design, Engineering, and Manufacturing teams to a new location within a building. From there, maybe Design and Engineering moved to a separate building. It’s possible Engineering was then moved to a separate domestic city due to lower employment cost and real estate values. Finally, perhaps Manufacturing was outsourced (fired locally) and sent overseas to be replaced by workers distant from the location of the core business. The thought then might have been, if it seemed to work for Manufacturing, then maybe Engineering would be next. The question we wonder is how does the saving in immediately observed overhead cost compare with the negative intangible costs?

Has this global interconnectedness of business operations caused a disconnect with core business success? Are companies becoming siloed, and do all segments understand the business they are in? Do outsourced or offshored constituents share the vision, accountability, and ownership style of the company? Has the connection to the customer, both internal and external, been compromised? Are geopolitics impacting supply or demand? We may be starting to see companies and industries acknowledge this, as they now realize that some of these intangibles have been exposed as unintended costs that can now be tangibly observed over the longer time period. We are beginning to hear the term onshoring, albeit minimal, and a recognition that costs that have become tangible may be curtailed by returning jobs domestically that were sent overseas. With the world now reversing into potential deglobalization, we wonder if this additional domestic investment will lead to contracting margins and slower growth. It may not take us too long to find out.

PORTFOLIO REVIEW4

Since peaking at the end of July, the S&P 500 Index has struggled over the last several weeks. The narrow market leadership seems exhausted, with many names that far outperformed the market through the first seven months of the year rolling over. Meanwhile, interest rates have been grinding higher globally. We believe interest rates will be higher for quite some time. We continue to maintain short positions in several real estate investment trusts (REITs) which tend to inversely perform when compared with the direction of interest rates. We maintain shorts in legacy data center REITs Digital Realty Trust, Inc. (DLR) and Equinix, Inc. (EQIX) as well as industrial warehouse REIT Prologis, Inc. (PLD).

This month we want to highlight our short position in Planet Fitness, Inc. (PLNT). Interestingly, PLNT’s 50-year-old CEO was fired abruptly in mid-September. This follows a very brief tenure of its President, who resigned after just 5 months on the job at the end of May. For those that can recall, we highlighted PLNT as a short early last year, noting that its business practices may be suspect and aggressive. We think there may be more bad news to come, and we currently maintain our short position.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners enjoy our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

Globalisation will make our societies more creative and prosperous, but also more vulnerable."– Lord Robertson, 2001

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: https;//www.weforum.org/, January 2023

4 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

Lord Robertson quote source: https://www.nato.int/

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner