The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 2.38% in July, compared to 3.21% for the S&P 500 Index. LBAY paid its thirty-second consecutive monthly distribution, at $0.075 per share in July. This is a 2.24% SEC yield versus the S&P 500 Index dividend yield of approximately 1.51%, and the 10-Year US Treasury yield of 3.962%. Year to date as of July 31, 2023, NAV for the Fund has declined 6.37%, compared to an advance of 20.65% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 46.37% cumulative total return and a 15.13% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

With our summer travel now complete, we find ourselves reflecting on the state of the US economy as we approach the end of August. In our experience, the supply issues of years past seem to have been closer to resolved. If we needed an item, the availability was more robust. If we needed a service, the appointment could be made with relative ease. However, the prices we had to pay for those items and services remain elevated even further beyond expectations. We found it easy to simply brush it off as “just the way it is now.” This is one of the Federal Reserve’s main fears with inflation, in that if people expect it, it then bears the risk of more permanence.

Extending, growing, increasing, strengthening, widening, expanding, inflating! These are the words we believe were etched into the brains of many after the world as we knew it came to its near “end” in March of 2020. The mantra appears to have changed over the course of the past handful of quarters, and now resounds with terms such as: reducing, declining, decreasing, weakening, tightening, contracting, deflating, tapering, and wait for it… shrinkage!

The term “shrinkage” seems to be a new trend and euphemism used by corporations with a weighting toward carrying physical inventory, rather than calling it what it really is…. theft. Will this become the new excuse du jour for why earnings are in decline, with hardly the slightest of nods to what may actually be happening? We think the consumer wallet is what has shrunk.

STATE OF THE CONSUMER

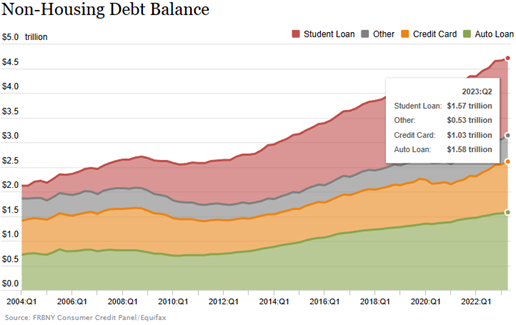

Credit card balances have risen to over $1 trillion based on data for the second quarter from the Federal Reserve Bank of New York3. We find this staggering and concerning. We have been referencing credit card balances as a data point for the past two years. Pointing back to our experiences this summer, we find it hard to believe the relief hoped for by spenders will be coming any time soon. Inflation levels may have slowed down, but the declines in prices may be wishful thinking rather than the soon-to-be coveted reality.

The trucking industry has long been considered a leading indicator of the US economy. Anecdotally, we recently had a long conversation with a truck driver who delivers long-haul across the US; he happens to be a senior men’s hockey player originally from Europe and plays in our league. As a twenty-something from outside the US, he quickly found high paying work delivering equipment across the country driving an eighteen-wheeler to and from Florida; his business had been booming for the last few years. Very recently, his business has slowed significantly as demand has declined and fuel prices are surging. Notably, industry participants are stating the same.

"I don't know that we've ever seen freight demand fall this far so fast and for so long without an accompanying economic recession4." - David Jackson, CEO of Knight-Swift Transportation Holdings Inc.

"Headwinds for freight remained in July, pushing the truck tonnage index lower. As has been the case for several months, a multitude of factors have caused a recession in freight, including sluggish spending on goods by households as consumers traveled more and went to concerts this summer. Less home construction, falling factory output, and shippers consolidating freight into fewer shipments compared with the frenzy during the goods buying spree at the height of the pandemic are also significant drags on tonnage5." - Bob Costello, American Trucking Associations Chief Economist

We suspect that consumer spending patterns likely did shift over the past several months and we believe this may portend significant re-rating in financial assets over the coming quarters. The datapoints from this earnings season surrounding the state of consumer suggest the consumer is slowing dramatically; we believe credit-fueled purchases of goods and services may not be sustainable.

PORTFOLIO REVIEW6*

We maintain several shorts tied to retail in the consumer discretionary space. We think the retail sector is experiencing major headwinds including both credit delinquencies and theft.

“…We have seen delinquencies rising gradually and they are now above pre-pandemic levels, which could result in higher credit losses in the second half and into 2024.” – Cathy Smith, CFO Nordstrom, Inc., Q2 2024 Earnings Call

“Unfortunately, we did not see the benefit we were expecting as the retail industry-wide shrink challenges continue and just have not abated.” – Kristin Wolfe, CFO Burlington Stores, Inc., Q2 2024 Earnings Call

“Two key factors impacted our second quarter gross margin relative to our original expectations. The first was the impact of higher inventory shrink. Organized retail crime and theft in general is an increasingly serious issue impacting many retailers…the impact of theft on our shrink was meaningful to both our Q2 results and our go-forward expectations for the balance of the year. We are doing everything we can to address the problem and keep our stores, teammates, and athletes safe.” – Lauren Hobart, CEO, Dick’s Sporting Goods, Inc., Q2 2024 Earnings Call

We continue to believe the consumer sector will face significant headwinds over the short and medium term. On September 1st, student loan balances will begin accruing interest again with the first debt repayments due in October 2023. We believe this will be an additional hurdle for spending. Short positions in the consumer discretionary space include. Lululemon Athletica Inc. (LULU), Five Below, Inc. (FIVE), Burlington Stores, Inc. (BURL) and Ollie’s Bargain Outlet Holdings, Inc. (OLLI).

On the long side of the portfolio, we highlight Comcast Corporation (CMCSA), a position we have held for quite some time. The stock has performed well this year advancing over 30% year to date through August 25, 2023. The shares are trading for around $45 at the time of writing this piece, but even with the recent strong performance the stock is well off its all-time of over $60 seen during 2021. We think the stock has more upside from current levels. The company owns a diverse set of businesses that include cable, broadband, wireless service, theme parks and studios, as well as one- third of streaming giant Hulu, which we think it will likely monetize soon. CMCSA owns the Philadelphia Flyers and its arena, as well as linear networks NBC, CNBC, and MSNBC. Its movie business, NBCUniversal, is having a banner year with movie releases Oppenheimer and Super Mario Bros. There is much to like at Comcast, and its valuation remains attractive in our opinion. CMCSA presently trades for around 12x times earnings and maintains a dividend yield of approximately 2.5%. Additionally, the company has been shrinking its shares outstanding as the company repurchased $2B of its stock during the 2nd quarter of 2023 and $11B worth over the trailing twelve months through June 2023.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners enjoy our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

The fun thing about investing is you’re constantly learning — sometimes by losing money, sometimes by making money when you didn’t expect to."– Joel Tillinghast, Fidelity

*Definitions: Earnings per Share Estimate is a company’s expected future annual earnings per share, as estimated by professional analysts. Forward Price to Earnings Multiple is the ratio for valuing a company that measures current share price divided by its forecasted earnings per share.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: https;//www.newyorkfed.org/, August 2023

4 Source: https;//www.investing.com/, August 25, 2023

5 Source: https;//wwwfleetowner.com/, August 25, 2023

6 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

Joel Tillinghast quote source: https://www.cnbc.com/

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner