The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 5.84% in May, compared to 0.18% for the S&P 500 Index. LBAY paid our eighteenth consecutive monthly distribution, at $0.065 per share in May. This is a 2.54% SEC yield versus the S&P 500 Index dividend yield of approximately 1.53%, and the 10-Year US Treasury yield of 2.847%. Year to date as of May 31, 2022, NAV for the Fund has returned 19.54%, compared to a decline of 12.76% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 52.69% cumulative total return and a 31.7% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.43%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

IT WAS ON THE TABLE

Don’t fight the Fed is the mantra that investors have been trained to use for years; the US Federal Reserve Board (the Fed) easy money policies provided market participants the backdrop to be long risk assets. Most recently, the Fed printed trillions of dollars to bail us out of the pandemic. In our opinion, there is little doubt that this money printing has led to excessive valuations in stock and bond markets and caused the highest levels of inflation in the US in forty years.

We think investors should remain true to the mantra and not fight the Fed. The Fed will be raising rates, and that is not the best environment for risk taking. The Fed’s response to the latest inflation numbers indicates policymakers may be more reactive than in control.

"A 75 basis point* increase is not something the committee is actively considering." – Jerome Powell on May 4, 2022

As it turns out, the 75 basis point* hike actually was on the table. The two-year US Treasury yield gapped higher by nearly a full percentage point in the span of a few short weeks. We are now starting to hear the word 4% being spoken by market experts as a potential interest rate level to be hit for multiple maturity levels. It was less than six months ago when the concept of breaching 2% was up for debate. Meanwhile, equity markets continue a painful re-rating, and consumer/producer prices continue the move into the stratosphere. We asked the question last month, and are doing so again: “…Is there anywhere to hide?” It’s becoming clear that price discovery is returning to markets. We view current market dynamics as healthy long-term, but we expect significant volatility in the nearer term as market participants and economic academicians assess the fluid macro backdrop.

“I think I was wrong then about the path that inflation would take. As I mentioned, there have been unanticipated and large shocks to the economy…. that I, at the time, didn’t fully understand.” – Janet Yellen

HAPPY TO PAY YOU NEXT TUESDAY

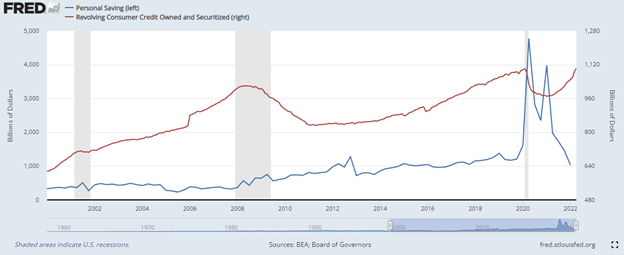

US personal consumption is the engine that drives the US economy, accounting for almost 70% of US gross domestic product. Notably, the amount of consumer savings has collapsed, while credit card and other revolver lines have hit all-time highs. We first pointed this out in August of 2021, and wondered if an uptick in credit borrowing was the result of rising costs and/or a potential savings depletion, or was it simply the resumption of past behaviors? We think the answer is obvious when seen in the below chart3, and likely has policymakers shuddering at all levels.

We think consumers are tapping credit lines to fund their lifestyles. Gas prices continue their step-up, and almost every household item has inflated higher. Consumers likely are anxious to “get out” again this summer, as the scars of being couped up during the pandemic remain. Exactly as consumers tap credit lines, interest rates are gapping higher; we question the medium-term ramifications for the US Consumer as we enter the second half of 2022 and then into 2023. A US recession is a real possibility.

WHO'S SWIMMING NAKED?

“Only when the tide goes out do you discover who’s been swimming naked.” – Warren Buffett

Will the triple whammy of depleted savings, higher debt levels, and the increasing cost of borrowing be too much and impair consumers? The next earnings cycle will be of great interest to us. We think the picture will become clearer on if and how businesses have been able to thread the needle of passing through costs to maintain margins, while at the same time attempting to retain those much-needed spenders. The pending riddle is how much is too much, and at what point do customers throw in the towel and simply say they can do without some of those items and services that are causing the trajectory seen the lines in the graph above? We think the next 18 months will provide the clarity around this question.

PORTFOLIO UPDATE*4

We recently initiated a short position in Doordash Inc (DASH). DASH introduced itself to public shareholders on December 8, 2020, issuing 33 million shares at $102 and raising $3.36 billion in proceeds. DASH’s business is local food delivery utilizing its Marketplace and Platform services “to grow and empower local economies”. In our opinion, DASH is an overvalued unprofitable technology stock that has limited ability to ever maintain sustained profitability. Notably, the only quarter in the company’s history when it turned a profit was in the second quarter of 2020, at the height of the COVID shutdown. Since then, the company has racked up seven consecutive quarters of losses and Wall Street forecasts are calling for further losses into the foreseeable future. At today’s levels, the company maintains a greater than $24.5B market cap, or over $21B enterprise value (EV) after netting its cash that’s left from its initial public offering. This equates to around a 3.4x EV/Sales multiple based on $6.1B in expected 2022 revenues. DASH’s closest peer GrubHub sold to Just Eat Takeaway.com in the Netherlands for over $7.3B in June of 2021. According to press reports, Just Eat Takeaway is shopping GrubHub for possibly as little as $1.3B and plans to offload the business less than a year after acquiring it. Other comparisons like UBER trade for less than 2x forward EV/Sales. We expect DASH to re-rate lower as more losses are likely reported in subsequent future quarters and years.

While we maintain a cautious view on the US macro-economic picture for the rest of 2022 and 2023, we note that the market is presenting some interesting values. Here we show our largest five long positions and their current market multiples, all of which we view as attractively valued.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners have enjoyed our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

For many years, the idea of don’t fight the Fed was if the Fed was going to be easy [on monetary policy.] You want to be long equities, but what changed dramatically this year is ‘don’t fight the Fed’ now means don’t fight the Fed when it’s fighting inflation. And that means that that’s not a good environment for equities on a short-term basis.” - Edward Yardeni

*Definitions: A basis point is one hundredth of one percent. One basis point is 0.01%. Enterprise Value (EV) is a measure of a company’s total value, and includes market capitalization, cash, and debt. EV/Sales multiple is the Enterprise Value to trailing 12-month sales ratio. Earnings per Share Estimate is a company’s expected future annual earnings per share, as estimated by professional analysts. Forward Price to Earnings Multiple is the ratio for valuing a company that measures current share price divided by its forecasted earnings per share.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3Source: https://fred.stlouisfed.org/, June 17, 2022

4View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Section Source: Bloomberg

5Edward Yardeni Quote Source: https://www.cnbc.com/, June 20, 2022

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner