The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 1.82% in February, compared to a decline of 2.99% for the S&P 500 Index. LBAY paid its fifteenth consecutive monthly distribution, at $0.065 per share in February. This is a 3.28% SEC yield versus the S&P 500 Index dividend yield of approximately 1.40%, and the 10-Year US Treasury yield of 1.827%. Year to date as of February 28, 2022, NAV for the Fund has returned 7.08%, compared to a decline of 8.01% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 36.78% cumulative total return and a 27.60% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.43%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

PRICE DISCOVERY RETURNS AS THE FED RETREATS

March 2022 marks the expected end of the Federal Reserve’s expansion of its balance sheet. With the taper now wrapping up, market participants seem to be facing an entirely different playing field. Perhaps we are returning to a market with true price discovery.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.” – Benjamin Graham

We believe the recent asset price volatility that has percolated since the end of 2021 will persist throughout 2022 as investors reset market expectations. Market-cap weighted passive investing may struggle as security price dislocations could favor actively managed* fundamental stock picking and long/short portfolios. In our opinion, the $47.5 trillion in Dow Jones US Total Stock Market Index market capitalization3 is ripe for price discovery as rates reset higher and risk appetites wane. We think the high company valuations supported by little-to-no-profits are unlikely to rebound in 2022. Investor portfolios levered long* to this high valuation subset may not recover any time soon.

“There will always be bull markets - followed by bear markets - followed by bull markets” – John Templeton

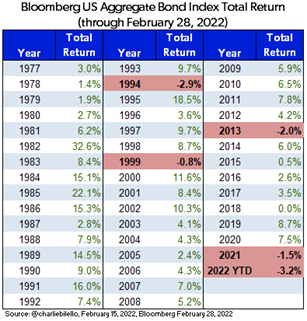

As market participants prepare for a Fed tightening cycle, global bond and equity markets are declining, while commodity prices are soaring. Here we show that 2022 year-to-date US bond total returns are on pace to be the worst in over forty years4.

Interestingly, there’s been only four occasions over the past 90+ years of data where US stocks as measured by the S&P 500 Index and US 10 Year Treasury bonds both finished down on the year5. Through February, the S&P 500 had fallen by 8% and the US Aggregate Bond Index had declined by 3.2%.

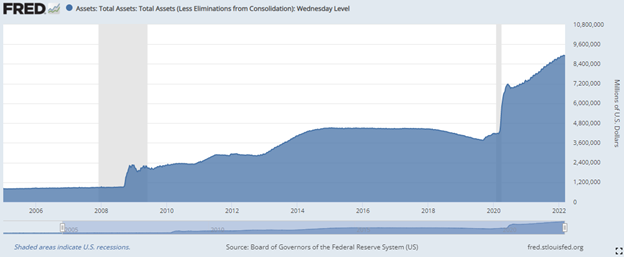

AN $8.9 TRILLION FED-CREATED BALANCE SHEET REMAINS

The week ending March 11, 2022 marked the Fed’s final bond purchases which signifies the end to the more recent expansion of its holdings that began two years ago. Over that two-year time frame the Fed more than doubled its balance sheet from $4.3 trillion to $8.9 trillion6.

“I think we would like to bring the balance sheet back to something consistent with where it was before the crisis which means enough to accommodate Americans demand for currency, plus a modest amount of reserves in the banking system, and that would suggest something under a trillion dollars.” – Ben Bernanke in March 2010

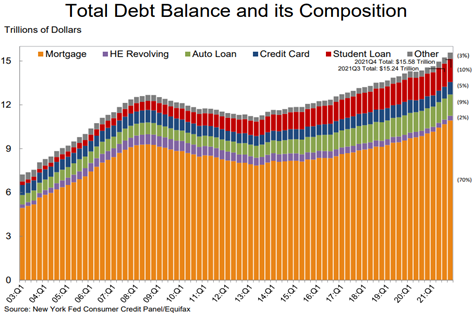

Fed balance sheet expansion and artificially engineered interest rates have led to many unintended consequences, including all-time high US Household debt. In August, we pointed out that there were indications the consumer had started borrowing on credit again. We questioned whether this was buy-now-pay-later because of rising costs, a result of savings depletion, or simply the resumption of past behaviors. We think it is a combination of these factors. The following are a few points released in February about fourth quarter 2021 household debt by the Federal Reserve Bank of New York7:

Here is a visual of fourth quarter 2021 household debt broken out by type:9

"The total increase in nominal debt during 2021 was the largest we have seen since 2007. The aggregate balances of newly opened mortgage and auto loans sharply increased in 2021, corresponding to increases in home and car prices." - Wilbert Van Der Klaauw, Senior Vice President at the New York Fed8

If you have been shopping for a car or home, you would have come to this conclusion without seeing any data. Interestingly, the number of car loans originated did not deviate much from past trend, but the notional dollar value of loans did. Buyers had to finance higher prices7.

The next question we ask is: will delinquency rates on all types of borrowing start to pick up after the effect of pandemic programs continues to be removed from the equation, including what will happen if student loan data reporting changes after the possible expiration of the programs?

Following the release of the data on household debt, we witnessed something noteworthy in the bond market. By the third week of February, bonds overall were selling off. By the end of the month, the selloff eased slightly in Treasury markets as we started to see volatility pick up given uncertainty surrounding the events evolving in Europe. The flight to safety dynamic picked up steam into the first week of March, but most of the curve is now back behind 2% at the time of writing this piece. Investors seem to have refocused on grappling with questions around how Fed policy tightening will unfold.

PORTFOLIO UPDATE10

After maintaining a net short exposure to the technology sector for the last several months, we recently initiated a long position while covering short positions in Zoom Video Communications, Inc. (ZM) and Shopify Inc. (SHOP) at considerable profit. Over the past several weeks we added long exposure to names in the technology and fintech space.

“Don’t throw the baby out with the bathwater”

We think Fidelity National Information Services Inc (FIS) is quite attractive at current levels and we have made it a core position in our portfolio. Based in Jacksonville, FL, the shares have sold off significantly as technology stocks generally re-rated lower. We think the selling pressure has been a result of outflows from the technology sector and growth factors more broadly; FIS has now declined more than 40% from its 2021 highs and over 17% year to date through the second week of March. Notably, unlike many unprofitable tech “story” stocks, FIS reported 44.1% adjusted EBITDA margins* during its full-year 2021 results11 and generates significant amounts of cash. FIS maintains a $54B market cap12 and provides technology solutions for merchants, banks and capital markets firms globally. Coinciding with its mid-February earnings, FIS announced plans to accelerate its annual dividend growth to 20% per year, beginning this March, and increase its dividend payout to 35% over the next several years. After the recent sell-off, FIS trades for just over 12x consensus 2022 expected earnings* and currently offers more than a 2% dividend yield12.

The short side of the portfolio has been particularly fruitful in 2022. We presently have high conviction in short position SVB Financial Group (SIVB), the parent company to Silicon Valley Bank. SIVB, which in investor relations materials deems itself “the bank of the global innovation economy”, maintains a $30B market cap, trades for around 2x book value and pays no dividend12. SIVB has achieved significant asset and earnings growth over the last several years as many of its venture-backed technology and life science company clients sought growth capital via investor dependent loans. Many of these loans are made to companies with modest or negative cash flows and/or no established record of profitable operations. Exit events, including public offerings and merger and acquisitions activity, contributed significant non-interest revenues and profits at SIVB. For example, in 2021 SIVB produced $2.724B in total pre-tax profits, with nearly half of those profits generated from gains of $0.761B and $0.56B from investment securities and equity warrants respectively. We suspect SIVB stock may decline substantially if those gains prove to be non-recurring in 2022, or if credit quality in their innovative technology loan book sours, both of which we view as likely.

FINAL THOUGHTS

Despite two consecutive down months for broader US equity markets to begin 2022, the Fund performed quite well posting positive performance in both January and February. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

Some people get rich studying artificial intelligence. Me, I make money studying natural stupidity." - Carl Icahn

*Definitions: Active management does not seek to replicate the performance of a specified index. Levered long refers to an investment strategy that uses borrowed funds to finance long positions to increase potential returns. EBITDA is a company’s earnings before interest, taxes, depreciation, and amortization. Adjusted EBITDA includes the removal of non-recurring, irregular, and one-time items. Adjusted EBITDA margin is Adjusted EBITDA / Revenue. Earnings per Share Estimate is a company’s expected future annual earnings per share, as estimated by professional analysts. Forward Price to Earnings Multiple is the ratio for valuing a company that measures current share price divided by its forecasted earnings per share.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3As of February 28, 2022. The Dow Jones US Total Stock Market Index is designed to measure all U.S. equity issues with readily available prices. It is a float-adjusted market cap weighted index. Indexes are unmanaged and it is not possible to invest in an index. Source: https://www.spglobal.com/

4Source: @charliebilello, February 15, 2022, Bloomberg February 28, 2022. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, mortgage-backed securities (MBS) (agency fixed-rate pass-throughs), asset-backed Securities (ABS) and commercial mortgage-backed securities (CMBS). Indexes are unmanaged and it is not possible to invest in an index. Source: Bloomberg

5Source: https://awealthofcommonsense.com/, February 13, 2022

6Source: https://fred.stlouisfed.org/, March 9, 2022

7Source: https://libertystreeteconomics.newyorkfed.org/, February 8, 2022

8Source: https://www.newyorkfed.org/, February 8, 2022

9Source: https://www.newyorkfed.org/, February 2022

10View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Source: Bloomberg

11Source: https://www.investor.fisglobal.com/, February 15, 2022

12Source: Bloomberg, March 14, 2022

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner