The Leatherback Long/Short Alternative Yield ETF (LBAY) advanced by 3.72% at NAV in February, compared to 2.76% for the S&P 500 Index. Cumulative inception to date, the Fund has returned 7.02%. LBAY paid its third consecutive monthly distribution of $0.06 per share this month, which equates to a 3.45% SEC yield versus the S&P 500 Index estimated 12-month dividend yield of approximately 1.5%.

If there has been a recurring theme in conversations with friends, family, investors, and colleagues, it is how much everyone just wants to get out. We don’t mean get out of the market, we mean get out literally, as in get outside and go somewhere.

As we lap the anniversary of the economy shutting down, we expect this pent-up consumer demand to outpace where we were in late 2019 and early 2020, pre-COVID. As shown in the chart below, January 2021 personal consumption spending was higher than 2019, and approaching 2020 pre-pandemic levels.

Chart: Personal Consumption Expenditures in Billions of Dollars, Seasonally Adjusted Annual Rate.

With that in mind, LBAY maintains long positions in RV maker Thor Industries Inc (THO), ski resort operator Vail Resorts Inc (MTN) and convertible preferred shares in theater owner EPR Properties (EPR). We expect these companies to benefit from increased consumer activity.

As the economy reopens and strengthens, Treasury yields have spiked, catching the attention of investors. On February 25th, The Treasury held a 7-year note auction that saw an unexpected bid-to-cover and tail. This caused the belly of the curve to back up over 20 bp at one point during the trading day. We have now seen the yield on the 5-year trading above 0.75%, and the 10-year go from just under 1% at the beginning of 2021 to dancing back and forth between 1.5% and 1.6% at the time of writing this piece. This is approaching the yield level at which the 30-year long bond was trading to start the year.

Historically, a 10-Year yield of 1.5% would not garner much, if any, attention. However, combined with recent comments from Federal Reserve Chair Jerome Powell, an increase in the pace of economic reopening could, “create some upward pressure on prices.” This clearly has the specter of inflation and rising interest rates back on people’s minds.

Fixed income participants were not alone. Equity markets were clearly rattled as well. This was reflected in tech share prices, which are sensitive to interest rates due to the discounting mechanism applied to valuations. We are seeing the shares of many of the bond proxies underperforming. As the markets and expectations recalibrate, we expect to see some interesting opportunities worth exploring through the lens of a potentially more inflationary and volatile interest rate environment.

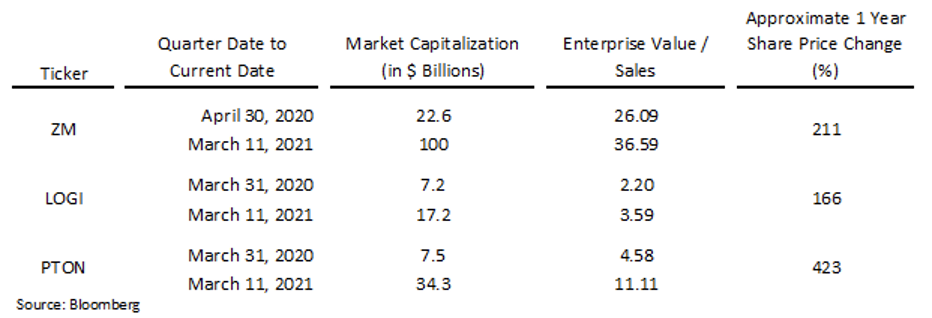

Turning our attention back to the consumer environment, the flip side to the suddenly mobile American consumer is clearly going to be some pain among the work/live/stay-at-home contingent, which does not bode well for companies like Zoom Video Communications (ZM), Logitech International (LOGI) and Peloton Interactive Inc (PTON). LBAY maintains short positions in each of these companies. As an aside, I have been taking frequent bike rides outside with my family, and it beat sitting indoors on a bike staring at a screen.

Chart: % Change in Share Price (Early days of Pandemic to March 11 Intraday)

From a macro perspective, we expect to see consumer demand increase against a backdrop of supply shortages. We are starting to see anecdotal indications of supply chain disruptions and an upward shift in input pricing pressures. We are witnessing unprecedented easy monetary policy, such as the $1.9 trillion stimulus package and related initiatives in the process of being passed and the clear message from the Fed about leaving rates alone, for now. Given these expectations and observations, we think we have positioned LBAY with mindfulness that realized inflation levels may get much higher than current market expectations imply. This is the reason we own companies that provide us certain factor exposures, such as food prices with Bunge Ltd (BG), agriculture and commodity prices with Nutrien Ltd (NTR) and Potlatchdeltic Corp (PCH), and energy prices with Exxon Mobil Corp (XOM).

As we close out another exciting month, we can say with certainty that we are part of the group that cannot wait to get out, see relatives, visit friends, travel to the places we have been missing, and do the things we’ve been waiting to do. We will be doing so safely, as we hope you will as well, and we look forward to continuing our dialogue in the weeks and months ahead.

"

Interest rates are like gravity in valuation. If interest rates are nothing, values can be almost infinite. If interest rates are extremely high, that’s a huge gravitational pull on value…” -Warren Buffett

1The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index's stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. Returns beyond 1 year are annualized. View LBAY standardized performance here.

3The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

4Chart Source: https://fred.stlouisfed.org/

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner