The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) NAV declined by 4.07% in November, compared to a decline of 0.69% for the S&P 500 Index. LBAY paid our twelfth consecutive monthly distribution, with an increase from $0.06 to $0.065 per share this month to celebrate the first anniversary of the Fund! This is a 3.57% SEC yield versus the S&P 500 Index dividend yield of approximately 1.32%, and the 10-Year US Treasury yield of approximately 1.45%. Year to date as of November 30, 2021, NAV for the fund has returned 11.08%, compared to 23.18% for the S&P 500 Index. Cumulative since inception (November 16, 2020) performance to date, NAV for the Fund has produced a 15.93% total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.09%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

Since forming in 2020, the Leatherback mission has been to provide premier actively managed* alternative strategies to all investors in the most optimal, and potentially tax-efficient** way – which we think is the ETF wrapper. Metaphorically speaking, we think actively managed strategies delivered via an ETF has similarities to the advent of music videos taking over the music radio genre. Anyone remember the song and first music video ever from 1981? Well, in 2021, we think the ETF killed the mutual fund star!

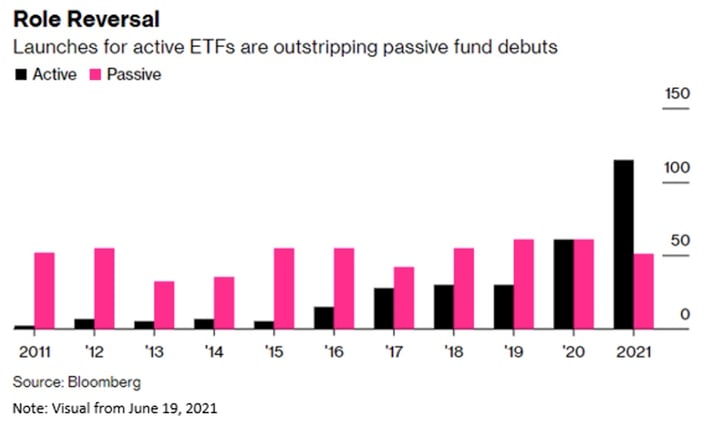

As seen in the above visual3, we think our industry thesis is proving correct as ETFs gather record assets and are being led by active strategies. Legacy mutual fund managers initially were slow to evolve and are now rushing to convert mutual funds to ETFs. We think the ETF wrapper has been well-received due to its client-centric features, daily transparency, and potential tax-efficiency**. Paramount to our approach, we formed Leatherback to launch liquid alternatives utilizing ETFs, which we view as the most investor-friendly format available in the marketplace.

WHY INVEST IN LBAY?

• Capital Appreciation Potential - Targets a net long exposure of between 75-110% invested across high shareholder yielding and income producing securities

• Targeted Monthly Distributions - Seeks to generate a monthly payout through dividends, interest and covered option writing

• Long/Short Strategy with Full Transparency - Daily disclosure of all long and short positions

• Less Correlation to Equity Markets - Seeks downside protection by taking short positions in overvalued securities

• Cost Effective - Offers a lower cost option to liquid alternative mutual funds and long/short limited partnerships

As we complete our first anniversary, we want to thank our corporate and investor partners, and wish you all a healthy and happy new year! We look forward to initiating and continuing the discussions with allocators as we head into year-end.

MARKET UPDATE

The last three months through November 2021 have witnessed many of what we think are Leatherback’s themes play out. Over the past year, we have discussed at length that we think inflationary pressures are profound and have greater permanence than what was being guided by the Federal Reserve. The Fed Chair has now decided to “retire” the term “transitory” when referring to the current inflation dynamic.

“I think it’s probably a good time to retire that word [transitory] and try to explain more clearly what we mean” – Jerome Powell, November 29, 2021

Supply chain problems are still an overhang, with an unclear picture of what the future will bring for the broad range of industries being impacted. We have noted what we thought could be a compression in profit margins given employment and cost pressures, and we are starting to see this take shape. We have talked about and seen oil and prices at the pump push higher than most Americans are comfortable with, and even policy coming out of Washington in an attempt to address the concern. Despite these headwinds, our last note pointed out the broad asset markets continued willingness to march on to higher and higher levels.

SO WHAT NOW?

The tape now finds itself having a difficult time making up its mind. One of the overarching questions of who the next Fed Chair would be has been answered. Now that Jerome Powell has been renominated for a second term, how policy will be implemented from here is the next driver of anxiety that markets are trying to sort through.

"The stock market, and risk assets broadly, have been supported for over a decade by the Fed's balance-sheet expansion. As we move into tapering and ultimately raising interest rates, it's turning into rougher waters for markets.4" – Jeffrey Gundlach

We now know after the December Federal Open Market Committee meeting that the Fed is very concerned about inflation prints and has already accelerated the taper schedule. The number of times they expect to raise interest rates over the next year or so has also ticked up. The questions now are what will happen given the capitulation on inflation and the grappling with the pace of the reduction of quantitative easing, and how and when will possible balance sheet runoff take place? Separately, the debt ceiling seems to be resolving itself with little fanfare. Finally, the latest variant has recently found itself in the news, and as we write this US Treasury yields, US equity markets and Oil are all playing a game of ping pong trying to figure out if and where new levels may land.

No matter how markets shake out, we think there are opportunities to explore, and we look forward to continuing our dialogue in the weeks and months ahead.

"

That’s not in the model. It’s uh, so uh, you know we live and learn." – Jerome Powell, November 29, 2021

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner