The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) advanced by 4.03% in April, compared to 5.34% for the S&P 500 Index. LBAY paid our fifth consecutive monthly distribution of $0.06 per share, which equates to a 3.11% SEC yield versus the S&P 500 Index estimated 12-month dividend yield of approximately 1.38%, and the 10-Year US Treasury yield of approximately 1.63%. Year to date, NAV for the fund has returned 15.06%, compared to 11.84% for the S&P 500 Index. Cumulative inception to date, NAV for the Fund has produced a 20.08% total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.09%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

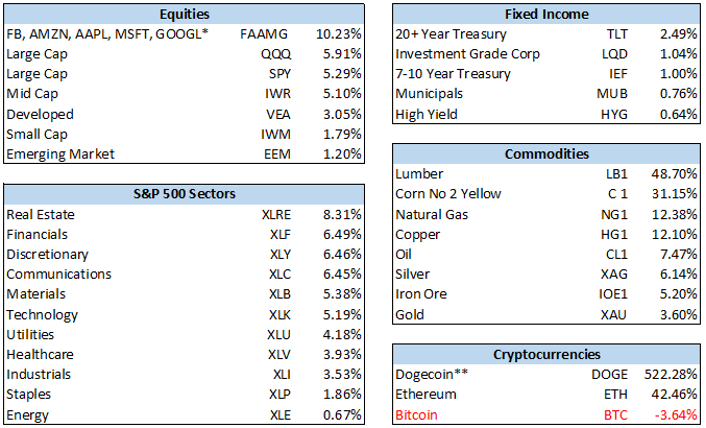

Asset prices rose everywhere during April. Unless the only thing you held was Bitcoin, or if you were a counterparty to Archegos Capital, it is most likely your portfolio was up during the month. Here is a broad sampling of returns for the month of April3:

We have liftoff! The year 2021 has witnessed sharp moves higher in the commodity and materials complex, with increased costs of many widely used raw materials. The prices of raw materials needed to make just about anything are skyrocketing. Depending on who you ask, the reason for this could be the Federal Reserve printing money and driving asset prices higher, helicopter payments to consumers causing soaring personal income levels facilitating demand pull-forward, or the catch-all statement “it’s COVID-related”.

“If you see lumber and not apples, you probably need to step away from your Bloomberg screen” – Peter Atwater @Peter_Atwater |

Do the economic data points suggest these price changes are going to be passed along to the consumer, and for the longer term? This is still unclear. We ask you to peruse your recent grocery bill, the changed number of items or the volume in a packaged good, the updated cost of the new home you were going to build, or the revised estimate for that remodel you were contemplating last year and are now getting around to finalizing. Semiconductor chips and lumber anyone? Yes, everything seems to be going higher.

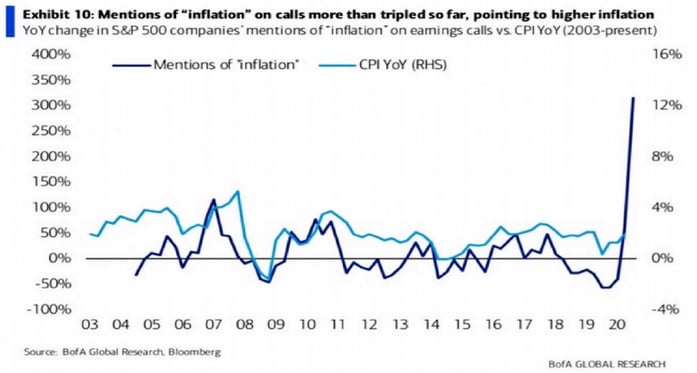

As a result of input price increases, we have started hearing a theme this quarter on earnings calls: Inflationary pressures on the raw material input mix used to produce final goods are impacting results.

We have been long several names we think are set up to benefit, rather than suffer, from this phenomenon. Bunge Ltd (BG) and Exxon Mobil Corp (XOM) remain two of our largest long positions due to their positive operating leverage to higher soft commodity and oil prices.

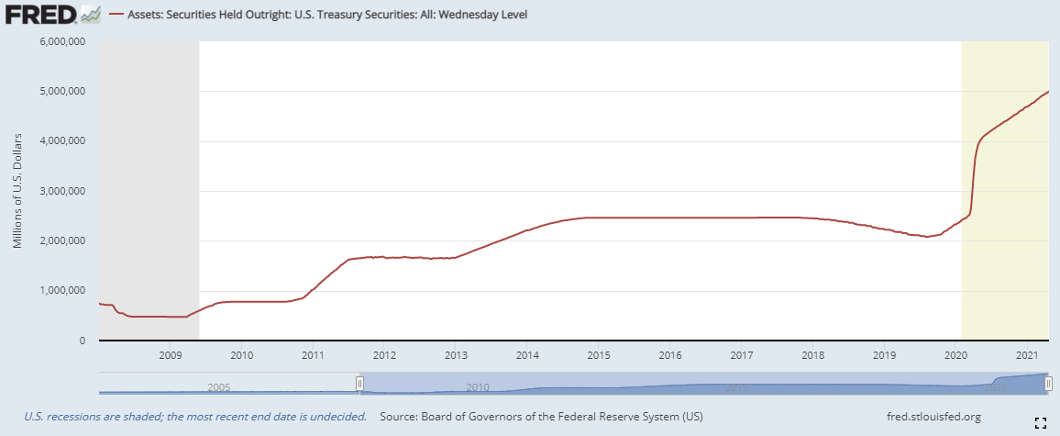

The Federal Reserve continues to say there is nothing to see here, but nominal yields and implied inflation breakevens have climbed since bottoming last year. During the last week of April, the first quarter GDP quarter over quarter price index came in higher than estimated. All of this is taking place in front of the backdrop of historic “stimulus” spending, on the order of trillions of dollars with more on the horizon and new programs being proposed at a steady rate. The issuance of Treasury securities that will be required to fund these initiatives is unprecedented.

As a counter-weight, at the same time the Fed is an active purchaser in open market operations and has indicated a willingness to stick around as a significant taker of supply. We can look at the trajectory of Federal debt and compare it to the total face Value of U.S. Treasury securities held by the Federal Reserve4 :

And then ask: How will this end?

"

We’re raising prices. People are raising prices to us, and it’s being accepted5.” – Warren Buffett

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: Bloomberg, *Average of the monthly returns, **Source: https://www.coindesk.com/

4 Source: https://fred.stlouisfed.org

5 Source: https://www.rev.com – Transcript of 2021 Berkshire Hathaway Annual Shareholders Meeting (May 1st)

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner