The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 4.91% in June, compared to 6.61% for the S&P 500 Index. LBAY paid its thirty-first consecutive monthly distribution, at $0.075 per share in June. This is a 2.54% SEC yield versus the S&P 500 Index dividend yield of approximately 1.55%, and the 10-Year US Treasury yield of 3.84%. Year to date as of June 30, 2023, NAV for the Fund has declined 8.55%, compared to an advance of 16.89% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 42.96% cumulative total return and a 14.62% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

Mega cap stocks have been a main story during the first six months of 2023. The sheer size in mega cap stock moves has been astounding. An estimated $4.1 trillion in market capitalization has been created across seven of the largest US stocks so far this year through June 30th, with year-to-date total returns that are equally as remarkable.

If you were not a holder of a few of these names in your portfolio, it is likely you are dramatically underperforming year to date. Interestingly as well, if you are a dividend-focused investor, only three of the seven names pay a dividend and none of them maintain even a 1% dividend yield! Artificial Intelligence-related names and technology sector stocks seem to be buoying “broad” US market indices.

If you are an active institutional investor underperforming, you are probably asking yourself what do I do now, and where should I invest for the remainder of 2023?

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown do not represent or predict the performance of the fund.

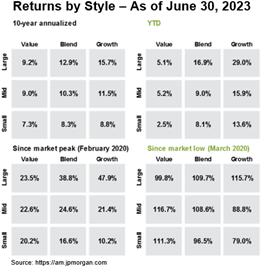

VALUE STOCK ROTATION PAUSED IN 2023 - WHAT NEXT?

In the market sentiment taking place not so long ago, equity investors found themselves rotating toward value securities and away from long duration* growth. Then 2023 arrived.

“It was an amazing first six months, like nothing we’ve ever seen… The capitalization-weighted S&P 500 was up about 17% through June 30. The equal-weighted S&P index rose only about 7%. Normally, when the market is up a lot, a large percentage of stocks are up as well. I’m looking at a table we prepared that shows the percentage of stocks in the S&P 500 that drove most of the returns in the 'up' years of 2017, 2019, 2020, 2021, and 2023. In 2017, 203 stocks, or 40% of index components, drove those returns. In 2019, it was 65%, and in 2021, 52%. In this year’s first half it was only seven stocks, or just over 1%, all tied to generative AI, that drove 80% of index returns. That’s extraordinary.” – Bill Priest

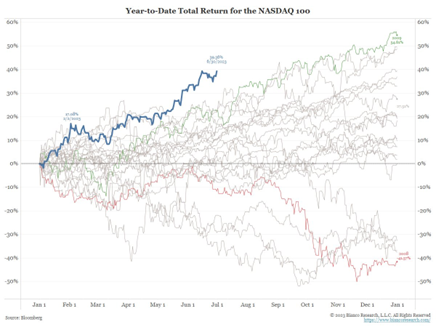

After celebrating throughout 2022, short sellers have been despondent so far this year. The NASDAQ 100 Index3 has returned nearly 40% year to date through June 30, which is its best start going back to 1999.4 However, we believe it would be premature to declare a new bull market for growth stocks.

In our opinion, the key measure to watch is interest rates, which are a crucial element in determining the value of future cash flows*; and importantly rates tend to follow the path of inflation. We do not get the feeling we are alone:

“Consumers are slowly using up their cash buffers, core inflation has been stubbornly high (increasing the risk that interest rates go higher, and stay higher for longer), quantitative tightening of this scale has never occurred, fiscal deficits are large….” – Jamie Dimon, 2nd Quarter 2023 earnings press release

PORTFOLIO REVIEW5

We have had positive outperformance recently from several long names across multiple sectors, including industrial Carrier Global Corporation (CARR), medical device maker Zimmer Biomet Holdings, Inc. (ZBH) and timber REIT PotlatchDeltic Corporation (PCH), each advancing by 22%, 14.5% and 14.7% respectively in June. Notably, Activision Blizzard, Inc. (ATVI), which we have been long since before the Microsoft Corporation (MSFT) takeover announcement in January 2022, has rallied sharply recently as MSFT nears the anticipated closing of the acquisition following approvals in the US and European Union. We expect to maintain our position in ATVI until the proposed deal closes in the upcoming months.

Next, Intercontinental Exchange, Inc. (ICE) continues to be a core long position in our portfolio. The $65B market capitalization company is awaiting approval of its acquisition of Black Knight, Inc. (BKI). As it awaits approval, the company has paused capital allocation decisions such as share buybacks and dividend increases. We expect closing of the deal could be a catalyst for the stock as it provides management the ability to resume focus on capital allocation as opposed to antitrust and legal issues.

Finally, the short side of the ledger has been very humbling in 2023 for the Fund. With nearly two decades of short-selling experience, we are unphased by what we view as temporary momentum in uneconomic security valuations. We believe the remainder of 2023 may provide the opportunity for much more alpha generation* than during the first half. Short positions are presently allocated with an inclination toward the US Consumer space, Technology and Real Estate, with an emphasis on idiosyncratic ideas with possible peak earnings and seemingly over-optimistic market sentiment.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners enjoy our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

I think that this is an extraordinarily dangerous and confusing period…Valuations are still very high…There’s a significant chance of recession. We see the possibility of a lengthy period of low returns in financial assets, low returns in real estate, corporate profits, unemployment rates higher than exist now and lots of inflation in the next round.” – Paul Singer

*Definitions: Duration measures a bond's or fixed income portfolio's price sensitivity to interest rate changes. Cash flow is the net amount of cash generated by a company, with cash received as an inflow, and cash spent as an outflow. Alpha-generation refers to a strategy that seeks to generate excess returns or value without additional risk.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. Indexes are unmanaged and it is not possible to invest in an index

4 Source: @biancoresearch, July 3, 2023

5 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

Bill Priest quote source: https://www.barrons.com/

Paul Singer quote source: https://www.wsj.com/

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner