The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 0.62% in April, compared to an advance of 1.56% for the S&P 500 Index. LBAY paid its twenty-ninth consecutive monthly distribution, at $0.075 per share in April. This is a 2.60% SEC yield versus the S&P 500 Index dividend yield of approximately 1.66%, and the 10-Year US Treasury yield of 3.425%. Year to date as of April 30, 2023, NAV for the Fund has declined 5.67%, compared to an advance of 9.17% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 47.46% cumulative total return and a 17.16% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

FACTOR FLIPS

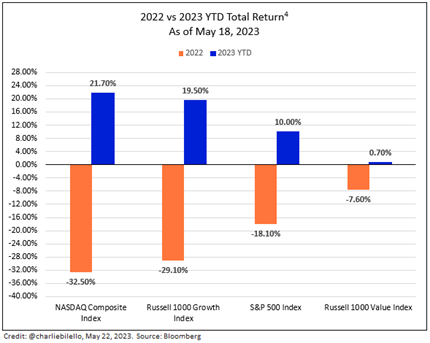

The year 2023 is proving to be the opposite of 2022. Last year, the NASDAQ Composite Index and large cap growth stocks performed poorly with the NASDAQ and Russell 1000 Growth Indices falling 32% and 29% in 2022. Year to date in 2023, the NASDAQ and large cap growth have far outperformed with the NASDAQ rising nearly 22% through mid-May and the Russell 1000 Growth rising almost 20%. In fact, since the lows printed for each of the indexes during the third quarter of 2022, both have risen over 24%3. Many theories abound as to why we are seeing the “V-shape” recovery in growth stock performance, but we believe that the market sentiment surrounding federal funds interest rate cut expectations has driven the buying frenzy. While the optics of the market’s resilience have been impressive, we note that an outsized portion of the returns have been driven by a handful of companies. We hypothesize that market participants have been caught off guard and the “fear of missing out” has caused momentum in too few names.

Factors that worked during 2022 have flipped during 2023. As we write this piece, we point out that buyback, dividend yield, profitability, quality, and value factors are negative, while growth has been off to the races this year3. In our opinion, the remainder of 2023 may be much different than the first several months, and long-short strategies should be a core part of allocator portfolios. Why do we think this? In the recent earnings cycle, we have seen a pick-up in companies acknowledging potential cracks in growth forecasts. One of the largest retail bellwethers recognized potential stresses on the consumer, and two major home improvement centers are seeing softer demand as the result of dips in discretionary spending.

NO HIGH FIVES FOR CONSUMERS

The US Federal Reserve Board (the Fed) has set the lower bound of the target rate range to the magical 5% number. This may sometimes be thought of as a psychological level for investors lending their cash at a perceived “attractive” rate. Many financial conversations and media pieces in the current environment are pondering the lure of placing cash into higher yielding money market instruments.

"How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case." - Robert G. Allen

It has been a while, and maybe the first time for many, where cash savings can earn a rate of return rather than being a potential cost. This coin has two sides, however, as what savers may observe as a boon, borrowers are likely viewing as a hindrance. Market participants ponder if 5% is the finish line for the Fed rate hiking cycle, but more importantly to us is what level of pain are borrowers willing to bear?

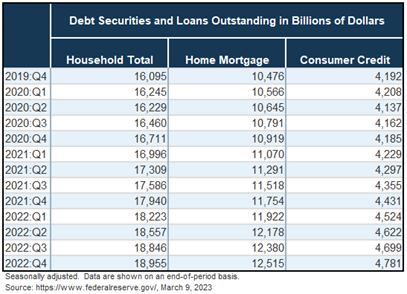

We refer to the Federal Reserve Statistical Release5 for the Fourth Quarter of 2022 and are impressed at the level of household debt. We wonder what the result will be for a consumer that reveals themselves to have taken on the highest levels of borrowing since data points going back to 1988. The annual growth rate of consumer credit in 2022 approached 8%, which is a level unseen since 2001. The annual rate of one-to-four family mortgages grew by over 7%, albeit slightly slower than in 2021. Annual growth in mortgage debt hasn’t been above a 7-handle since 2007, or before the previous housing market disaster. The trend in seasonally adjusted annual rates for each quarter in both categories during 2022 has been down, with mortgage debt growth slowing more than credit. The bottom line for us is that consumer credit was still in growing mode when rounding out 2022.

$19 Trillion! This was the level of household debt outstanding to end the fourth quarter. $12.5 Trillion of this was in mortgages, while almost $4.8 Trillion was in the form of consumer credit. Take these staggering numbers and pair them with interest rates that have risen further since then but may not yet have arrived at the terminal rate. Could this combination prove to be, as the Chair of the Fed posits: “sufficiently restrictive” to the Consumer?

“…we’ve been raising interest rates, and that raises the price of credit, and that, in a sense, restricts credit in the economy,

working through the price mechanism.” - Jerome Powell

PORTFOLIO REVIEW6

After a total return of over 22% in 2022, the performance of our Fund has struggled to start 2023. Notably, the short positions that worked so well for us in 2022 have been detractors in 2023. While we did not expect the rally in our short positions, we believe this underperformance will be temporary and is more factor-driven than idiosyncratic. We continue to maintain short positions in consumer discretionary names as we believe the US Consumer is rolling over. We also believe the names that have narrowly led the market in 2023 maintain the most risk for capitulation. We have a negative bias to high sales growth and unprofitable story stocks; names that despite their sales growth, continue to hemorrhage cash.

On the long side of the ledger, we maintain exposure to companies in the healthcare sector as we think healthcare will perform well if we enter a recessionary environment. We are long AbbVie Inc. (ABBV), GE Healthcare Technologies Inc (GEHC), Johnson & Johnson (JNJ), Medtronic, PLC (MDT), and Zimmer Biomet Holdings, Inc. (ZBH).

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

Since launching in November 2020, we believe our Fund has performed well. However, we have had multiple observation periods where we detracted. Notably, we have had three drawdowns near and over 10% on a total return basis. Having said this, we strive to measure our success over the longer term, as generating positive alpha* over long periods of time cannot occur in a straight line. We appreciate our investor partner’s support, and we look forward to continuing our dialogue in the weeks and months ahead.

"

I’m sitting here staring in the face at the biggest and probably the broadest asset bubble — forget that I’ve ever seen, but that I’ve ever studied,” Stanley Druckenmiller

*Definitions: Alpha-generation refers to a strategy that seeks to generate excess returns or value without additional risk.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was developed with a base level of 100 as of February 5, 1971. The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The index was developed with a base value of 200 as of August 31, 1992. Indexes are unmanaged and it is not possible to invest in an index. Source: Bloomberg

4 Credit: @charliebilello, May 22, 2023. The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was developed with a base level of 100 as of February 5, 1971. The Russell 1000 Growth Index measures the performance of those Russell 1000 companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The Russell 1000 Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. The index was developed with a base value of 200 as of August 31, 1992. Indexes are unmanaged and it is not possible to invest in an index. Source: Bloomberg

5 Source: https://www.federalreserve.gov/, March 9, 2023

6 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Section Source: Bloomberg unless otherwise noted.

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner