The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) advanced by 5.17% in January, compared to a decline of 5.17% for the S&P 500 Index. LBAY paid our fourteenth consecutive monthly distribution, at $0.065 per share in January. This is a 3.16% SEC yield versus the S&P 500 Index dividend yield of approximately 1.34%, and the 10-Year US Treasury yield of 1.778%. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 34.33% cumulative total return and a 27.67% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.43%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

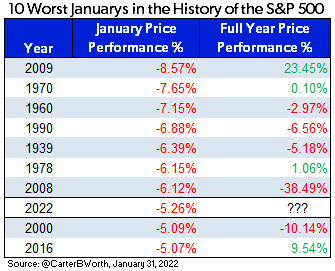

The month of January 2022 marks the worst start to a year for the S&P 500 since 2009, and the 8th worst in S&P 500’s history3. What happens in January does not necessarily portend a negative S&P 500 return year. But, if history is any guide, we think it is unlikely to be a robust performance year for investors.

We believe the sentiment shift taking place among market participants is welcome and healthy for asset markets in general. We believe the environment is very constructive for long/short portfolios, with alpha generation* to be had as security prices rise and fall as risk appetites broadly reset.

“The stock market is the story of cycles and of the human behavior that is responsible for overreactions in both directions.” – Seth Klarman

Just one year ago, WallStreetBets and Meme stocks dominated the market narrative. As we said in many conversations last year, the market action in stocks mentioned on Reddit or WallStreetBets reminded us of the streaker who jumped on the field during the football game; it’s not part of the game we came to watch, but how could you not look as it was happening!? Well, we think those that were rooting for the streaker have sobered. We think the “diamond hands” and “bag holders” are leaving a trove of opportunities both long and short.

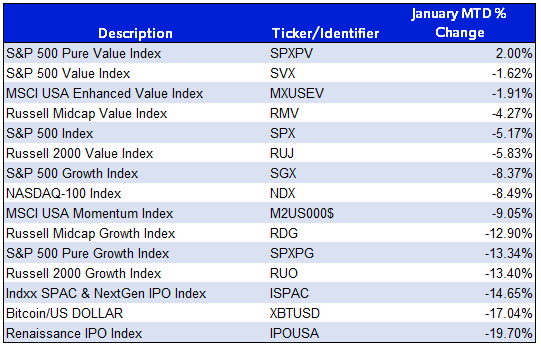

Meanwhile, value strategies have been significantly outperforming growth recently, although most value benchmarks declined in January – just not nearly as much as growth. Growth investors witnessed substantial declines across all capitalizations. Additionally, new issues in both the initial public offering (IPO) and special purpose acquisition company (SPAC) categories struggled, as did Bitcoin, as you can see in the below month-to-date total return table4.

In our opinion, this sentiment shift away from unprofitable growth stocks is unlikely to be transitory, and fundamental stock picking will be rewarded as Central Bank liquidity is drained.

CURVE BALL

As the Fed pontificates about tapering and warns of upcoming rate hikes, the US Treasury yield curve has flattened, with the spread between the 2-Year and 10-Year recently contracting to near 60 basis points*. As most investors are likely aware, a flattening yield curve oftentimes leads to a recessionary economy. The below illustrates the flattening of the curve5. We think the economy has a high probability of a slowdown as we lap fiscal stimulus and potential tightening takes shape.

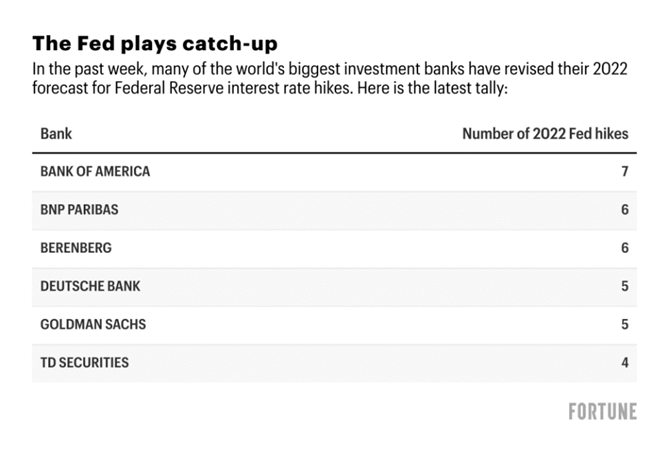

Meanwhile, we are seeing sell-side research firms revising their 2022 forecasts on cue, in line with where prices have headed. It is likely stock and bond market volatility may change the cadence of interest rate hikes. At the same time, inflationary readings may force the Fed’s hands. Below we show the expectations some of the sell-side banks currently have regarding future Fed moves6.

We are of the strong opinion that if the Fed hits even the bottom end of expectations – i.e., 4 rate hikes, the market volatility will provide for an eventful year and a disappointing one for growth strategies.

“While higher interest rates increase borrowing costs for all businesses, they also make firms’ projected profits worth less in investors’ valuation models. This is exacerbated for tech and other growth stocks whose peak earnings are not expected for years to come6." – Nigel Green, CEO of DeVere Group

PORTFOLIO UPDATE7

“Behold the turtle. He makes progress only when he sticks his neck out.” - James Bryant Conant

Leatherback entered 2022 with a sizable, long allocation in Activision Blizzard (ATVI). We made our first purchase of ATVI on November 22, 2021, when the stock traded at a little over $62. We accumulated shares over the subsequent weeks as we thought the value proposition was too glaring to ignore, as the stock traded to multi-year lows while maintaining a fortress balance sheet of $6B in net cash along with rich entertainment assets. To our pleasant surprise, and to start the third week of January, Microsoft Corp (MSFT) announced plans to acquire the company for $95 per share in cash. This was more than a 40% all cash premium with an expected closing in 2023. Notably, the stock initially hovered around $82 on the day the deal was announced and has since drifted to near $79 per share, or a roughly 17% discount to its expected takeout price. We believe the deal will undergo antitrust scrutiny but will ultimately be consummated. We expect to maintain a position until the deal discount closes.

We have been adding to Newmont Corporation (NEM) and have made it a top five position in our long portfolio. NEM is the only gold company in the S&P 500 and presently maintains a market capitalization of around $49B with minimal debt and a dividend yield of more than 3.5% at the time of writing this piece. In our opinion, the sentiment surrounding gold and gold stocks seems too bearish. In 2021 the Gold Spot price declined by over 3.6% while the NYSE Arca Exchange Gold BUGS Index fell by more than 12%. Over the last two years the money supply has exploded higher and inflation measures have spiked upward. Historically, these dynamics have been bullish for gold and gold stocks. We suspect that as risk taking appetites wane, sentiment surrounding gold stocks will improve and stock prices will march higher. We view NEM as the best proxy to participate in a strong rebound in gold and gold stocks.

On the short side of the ledger, we initiated a position in Planet Fitness (PLNT), a franchisor and operator of low price point fitness centers. PLNT boasts an almost $7.7B market cap with over 2,000 stores and 15 million members. The stock presently trades for nearly 17x revenues, over 100x estimated earnings and approaches 40x EBITDA*. PLNT thrives on customers paying monthly fees that are automatically swept from customer bank accounts. PLNT makes it easy to sign up for a subscription, but very difficult to cancel. Federal regulators have made it a priority to crack down on the widespread practice.

“If you click to subscribe, you should be able to click to cancel. FTC has made clear that to comply with the law, businesses must ensure sign-ups are clear, consensual, and easy to cancel.” – Lina Khan, Chair, Federal Trade Commission

Recently, Lina Khan tweeted out a video showing Planet Fitness as violating the policy. Next, PLNT has recently announced acquisitions of franchisees, including an $800mn acquisition of franchisee Sunshine Fitness. We question why a company whose business is based on franchising would be acquiring franchisees. Given what we think is the company’s high valuation and significant insider selling, we think a short position may prove fruitful.

FINAL THOUGHTS

Despite the tumultuous market dislocation in January, our Fund performed quite well posting positive performance. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

A pessimist sees the difficulty in every opportunity, an optimist sees the opportunity in every difficulty. " - Winston Churchill

*Definitions: Alpha-generation refers to a strategy that seeks to generate excess returns or value without additional risk. A basis point is one hundredth of one percent. One basis point is 0.01%. Revenue multiple is the Enterprise Value to trailing 12-month sales ratio. Enterprise Value (EV) is a measure of a company’s total value, and includes market capitalization, cash, and debt. Earnings per Share Estimate is a company’s expected future annual earnings per share, as estimated by professional analysts. EBITDA multiple is the EV to (trailing 12-month EBITDA + adjustments for Operating Lease). EBITDA is a company’s earnings before interest, taxes, depreciation, and amortization.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3Source: @CarterBWorth, January 31, 2022

4View LBAY top 10 holdings here. The S&P 500 Pure Value index is a style-concentrated index designed to track the performance of stocks that exhibit the strongest value characteristics by using a style-attractiveness-weighting scheme. The S&P 500 Value Index is a market capitalization weighted index. All the stocks in the underlying parent index are allocated into value or growth. Stocks that do not have pure value or pure growth characteristics have their market caps distributed between the value & growth indices. Prior to 12/19/2005 this index represented the S&P 500/Barra Value Index. The MSCI USA Enhanced Value Index captures large and mid-cap representation across the US equity markets exhibiting overall value style characteristics. The index is designed to represent the performance of securities that exhibit higher value characteristics relative to their peers within the corresponding GICS® sector. The value investment style characteristics for index construction are defined using three variables: Price-to-Book Value, Price-to-Forward Earnings and Enterprise Value-to-Cash flow from Operations. Russell Midcap Value Index measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. Russell 2000 Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The S&P 500 Growth Index is a market capitalization weighted index. All the stocks in the underlying parent index are allocated into value or growth. Stocks that do not have pure value or pure growth characteristics have their market caps distributed between the value & growth indices. Prior to 12/19/2005 this index represented the S&P 500/Barra Growth Index. The NASDAQ-100 Index is a modified capitalization-weighted index of the 100 largest and most active non-financial domestic and international issues listed on the NASDAQ. No security can have more than a 24% weighting. The MSCI USA Momentum Index is based on MSCI USA Index, its parent index, which captures large and mid cap stocks of the US market. It is designed to reflect the performance of an equity momentum strategy by emphasizing stocks with high price momentum, while maintaining reasonably high trading liquidity, investment capacity and moderate index turnover. Russell Midcap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. S&P Pure Growth Indices includes only those components of the parent index that exhibit strong growth characteristics, and weights them by growth score. Russell 2000 Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values. The Indxx SPAC & NextGen IPO Index is a passive rules-based index that tracks the performance of the newly listed Special Purpose Acquisitions Corporations (“SPACs”) ex- warrant and initial public offerings derived from SPACs since August 1, 2017. The Renaissance IPO Index is a divers. portfolio of US-listed newly public companies that provides exposure to securities under-represented in broad benchmark indices. IPOs that pass a formulated screening process are weighted by float, capped at 10% and removed after two years. Indexes are unmanaged and it is not possible to invest in an index. Sources: Bloomberg, https://www.spglobal.com/, https://www.msci.com/

5Source: https://fred.stlouisfed.org/, January 31, 2022

6Source: https://www.fortune.com/, January 31, 2022

7View LBAY top 10 holdings here. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. The NYSE Arca Gold BUGS Index is a modified equal-dollar weighted index of companies involved in major gold mining. The index was designed to give investors significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1½ years. The index was developed with a base value of 200 as of March 15, 1996. Indexes are unmanaged and it is not possible to invest in an index. Source: Bloomberg

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner