The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) declined by 0.24% in December, compared to a decline of 5.76% for the S&P 500 Index. LBAY paid our twenty-fifth consecutive monthly distribution, at $0.075 per share in December. This is a 2.24% SEC yield versus the S&P 500 Index dividend yield of approximately 1.76%, and the 10-Year US Treasury yield of 3.877%. Year to date as of December 31, 2022, NAV for the Fund has returned 22.39%, compared to a decline of 18.11% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 56.33% cumulative total return and a 23.42% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.32%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

WE EXPECT TRIED-AND-TRUE INVESTMENT STRATEGIES TO THRIVE IN 2023 AND BEYOND

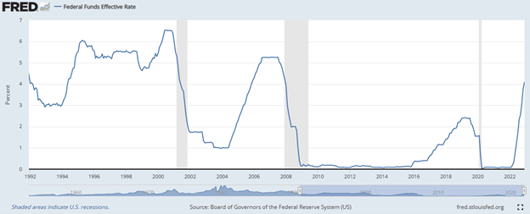

From 2008 until 2022, the US Federal Reserve Board (the Fed) suppressed interest rates, implemented quantitative easing, and created money out of thin air. Fed actions encouraged market participants to speculate in a host of financial assets. The greatest rewards were reaped in US equities. Specifically, levered long beta* strategies favoring growth investments outperformed most investment strategies, and proved fruitful for over a decade. In 2022, the zero-interest rate party ended as the Federal Reserve implemented a series of aggressive rate hikes with seven increases from March through December. As the Fed engineered its rate hiking path, financial assets struggled throughout 2022 with the total returns of the S&P 500 Index falling by over 18%, the growth heavy NASDAQ Composite Index collapsing by more than 32%, and the Dow Jones Industrial Average declining by almost 7%. US Bonds declined similarly with broad-based investment grade bonds falling by 13%, corporate bonds by almost 16%, high yield bonds by over 11%, mortgage-backed securities by nearly 12%, and “safe haven” Treasuries by more than 12%! To wrap up the year, the 60/40 model fell by nearly 17%**.

“Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.” – Warren Buffett

Below is a visual showing the Fed interest rate actions over the past 30 years, with a 2022 summary table outlining the rapid hikes totaling 4.25% (425 basis points*) during the year3:

As we initially discussed during the first quarter of 2022, we think tighter monetary policy and higher volatility coupled with passive investment flow shifts should lead to price dislocations and, importantly, true price discovery. In our opinion, the setup for tried-and-true alternative strategies such as long/short, capital structure arbitrage and managed futures appear particularly favorable as we enter 2023. Notably, the setup in 2022 was a healthy one for short selling strategies, as many equities with valuations we viewed as launched into the stratosphere coming back down to earth.

“We believe 2022 will be ripe for stock picking. We think fundamentals matter, and the opportunities that are available may lead to 2022 being an alpha-generating* year for short selling.” – Leatherback Asset Management, January 2022

We believe 2023 will be opportune for fundamental investing styles, and the craft of good old fashioned financial statement analysis is paramount. We imagine 2023 may be a continuation of 2022 as short candidates appear numerous, albeit not quite as plentiful as a year ago.

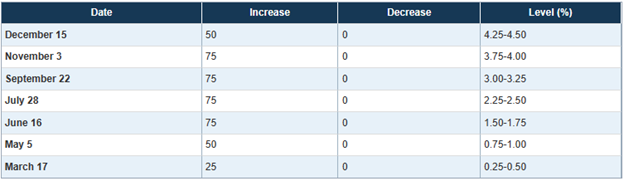

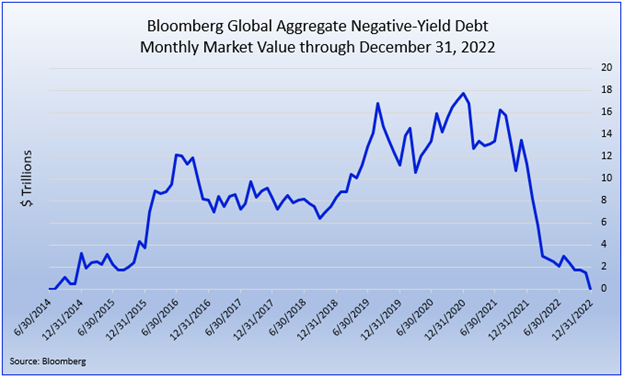

THE VANISHING OF NEGATIVE YIELDING DEBT

Another indication that the world of financial instruments is normalizing can be witnessed in the sovereign debt markets. We think price discovery is returning as Central Banks remove support. In April 2022, we found a bond market paradigm that seemed very telling and had to question whether the negative interest rate experiment was ending. Now, we have the answer, and cash is back to having a tangible value associated with it in the form of earning interest. When we posited the question early last year, the market value of negative-yielding debt globally has just slid to below $3 Trillion after reaching $18 Trillion during the pandemic. The global market value is now trending to near zero in bond market terms and stood at just over $24 Billion to end the year4. We think the below visual is staggering:

PORTFOLIO UPDATE5

While the Fund certainly had its share of detractors in 2022, we are proud with the number of names that positively contributed to performance. Both long and short positions provided positive attribution to the portfolio for the year ended December 31, 2022. Notably, short positions in Carvana Co (CVNA), Silvergate Capital Corporation (SI), and SVB Financial Group (SIVB) were the largest short winners on the year. At the time of this writing, we are no longer short CVNA or SI but remain short SIVB. No short position materially detracted in 2022. On the long side, Exxon Mobil Corporation (XOM), H&R Block, Inc. (HRB) and Lancaster Colony Corporation (LANC) were all important positive contributors on the year. Our three largest long detractors included Hasbro, Inc. (HAS), Fidelity National Information Services, Inc. (FIS) and EPR Properties Preferred Shares (26884U208). At the time of this writing, we continue to remain long all six names.

As we enter 2023, we remain short Tesla Inc. (TSLA), a short position we have maintained since 2020. We believe the current slide in TSLA will continue unabated. While we have no unique thesis outside of what many pundits have articulated, we share the view that TSLA engages in aggressive accounting, is experiencing weakening demand for their electric vehicles, maintains abysmal corporate governance (including a promotional CEO and dilutive share compensation), and faces well-financed competition. We believe the catalyst for TSLA stock declining further will simply be “gravity”. We believe higher interest rates, weaker market sentiment, and the law of large numbers (TSLA maintains an over $340 Billion market capitalization as we write this) will finally force TSLA valuation more in line with its capital-intensive automotive peer group.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

Leatherback is thankful for those that have entrusted us. Our goal has been to provide institutional quality long/short investing alternatives to the masses in a fully transparent, and potentially tax efficient Exchange Traded Fund (ETF)6. As we enter the new year, we hope you consider us for an allocation in 2023 and beyond.

"

Short sellers are the market’s police officers. If short selling were to go away, the market would levitate even more than it currently does.” – Seth Klarman

*Definitions: Levered long refers to an investment strategy that uses borrowed funds to finance long positions to increase potential returns. Beta is the percent change in the price of the security given a 1% change in the market index. A basis point is one hundredth of one percent. One basis point is 0.01%. Alpha-generating refers to a strategy that seeks to generate excess returns or value without additional risk.

**The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was developed with a base level of 100 as of February 5, 1971. The Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS. The Bloomberg US Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD denominated securities publicly issued by US and non-US industrial, utility and financial issuers The Bloomberg US Corporate High Yield Bond Index measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody's, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on Bloomberg EM country definition, are excluded. The Bloomberg US Mortgage Backed Securities (MBS) Index tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The index is constructed by grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. The Bloomberg US Treasury Index measures US dollar-denominated, fixed-rate, nominal debt issued by the US Treasury. Treasury bills are excluded by the maturity constraint, but are part of a separate Short Treasury Index. STRIPS are excluded from the index because their inclusion would result in double-counting. The Bloomberg US EQ:FI 60:40 Index is designed to measure cross-asset market performance in the US. The index rebalances monthly to 60% equities and 40% fixed income. The equity and fixed income allocation is represented by Bloomberg US Large Cap and Bloomberg US Agg respectively. Indexes are unmanaged and it is not possible to invest in an index. Source: Bloomberg.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3 Source: https://fred.stlouisfed.org/ and https://www.federalreserve.gov/, Jan 4, 2023

4 Source: Bloomberg

5 View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Section Source: Bloomberg unless otherwise noted.

6 In general, ETFs can be tax efficient. ETFs are subject to capital gains tax and taxation of dividend income. However, ETFs are structured in such a manner that taxes are generally minimized for the holder of the ETF. An ETF manager accommodates investment inflows and outflows by creating or redeeming “creation units,” which are baskets of assets. As a result, the investor usually is not exposed to capital gains on any individual security in the underlying portfolio. However, capital gains tax may be incurred by the investor after the ETF is sold.

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner