The Leatherback Long/Short Alternative Yield ETF (LBAY) (the “Fund”) net asset value (NAV) declined by 6.36 % in September, compared to a decline of 9.21% for the S&P 500 Index. LBAY paid our twenty-second consecutive monthly distribution, at $.065 per share in September. This is a 2.64% SEC yield versus the S&P 500 Index dividend yield of approximately 1.85%, and the 10-Year US Treasury yield of 3.832%. Year to date as of September 30, 2022, NAV for the Fund has returned 5.42%, compared to a decline of 23.87% for the S&P 500 Index. NAV performance for the Fund to date since inception (November 16, 2020) has produced a 34.66% cumulative total return and a 17.24% annualized total return.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. Performance current to the most recent month-end can be obtained by calling (833) 417-0090. The gross expense ratio for the fund is 1.43%.

View LBAY standardized performance here.

The Fund’s NAV is the sum of all its assets less any liabilities, divided by the number of shares outstanding. The market price is the most recent price at which the Fund was traded.

BEAR MARKET RALLY ENDS WITH A WHIMPER

Markets have been sliding lower after a nice summer rally. From the recent low in mid-June 2022 through mid-August the S&P 500 Index produced a total return of over 17%. Since then, the market has retraced all those gains and is resting near the lows of the year at the time of this writing. In our opinion, the hope of a Federal Reserve “pivot” (rate cuts in 2023) and soft landing drove the risk-on mid-summer bullish sentiment. Meanwhile, Chairman Jay Powell seems to have morphed into Paul Volcker over the last several months. Notably, the US Federal Reserve Board (the Fed) has hiked rates five times over that time span. In public appearances Chair Powell has repeatedly referenced Volcker when referencing inflation, recently stating that “we must keep at it until the job is done” invoking Volcker’s 2018 biography “Keeping At It”. Not surprisingly, as interest rates reset higher, stretched stock and bond valuations re-rated lower. We think this environment is ideal for long-short strategies.

SINGLE MANDATE

“Until inflation comes down a lot, the Fed is really a single mandate central bank.3” – Former Fed Vice Chair Richard Clarida

We questioned the concept of the potential fallacy of the Fed “dual mandate” in our insights almost a year ago to the day. We pointed to market and asset prices as a possible, if not probable, driver of much of the policy seen leading up to that time. The Fed seemed to indicate at the time that deflation was a concern, so policy was guided in the direction of lifting prices above the stated 2% target rate of inflation.

“I would say our policy is well positioned to manage a range of plausible outcomes — I do think it’s time to taper, and I don’t think it’s time to raise rates. It would be premature to do so at a time when we are far below the level of jobs we had in 2020.4” – Jerome Powell in October 2021

This tone has clearly changed, as the messaging is being conveyed loud and clear: prices are too high and must come down. This seems to be the only mandate of the traditional two that the Fed is focusing on, no matter how much market participants may not want to believe it. Interestingly, bullish market participants search for a new narrative to justify holding risk assets. A year ago, inflation was transitory. This past summer the Fed pivot drove a bear market rally. We are now being introduced to a “stepping down” in interest rates, which is the equivalent of smaller incremental interest rate increases.

“The time is now to start planning for stepping down.5” - San Francisco Fed President Mary Daly

2000 vs 2022

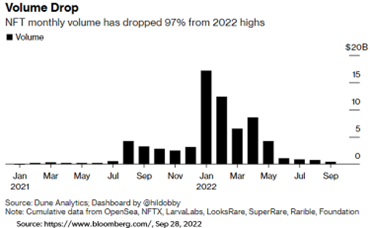

The founders of Leatherback both entered the investment management industry near the end of the dot-com bubble. The current investing climate seems to rhyme with the 2000 to 2002 period. It has been quite nostalgic to listen to and witness this generation learn about investing. When we first entered the investment management industry in 1999, the world was captivated by technology stocks. At the time, many were dabbling in the shares of internet companies, and were discussing reaping paper wealth. There was a fascination with the internet and any stock with a “dot-com” at the end of it. In 2000 it all crashed, and by late spring of that year, we do not recall anyone boasting about any realized gains. Growth stocks were walloped, and growth equities declined for a couple of years thereafter. History seems to be repeating; over the last two years, we have heard quite a bit about metaverse companies, social media, cryptocurrencies, and non-fungible-tokens (NFTs). A recent article pointed out NFTs specifically, showing how recent policy is impacting speculative assets6:

In the year 2022 through the end of September 30, total returns have exhibited pain. Growth equities have declined significantly with the S&P Growth Index7 and NASDAQ Composite Index7 falling over 30% each. The Ball Metaverse Index7 declined more than 50% and the BUZZ NextGen AI US Sentiment Leaders Index7 has tumbled 45%. AMC Entertainment Holdings, Inc. stock – a poster child stock for the fintwit crowd- is now down more than 58% year to date through the end of the third quarter.

Anecdotally, I recently had a twenty-two-year-old nephew of mine ask me about Series I Savings Bonds (I Bonds) and Certificates of Deposit (CDs). Previous conversations had typically centered around NFTs, the metaverse or crypto. He no longer has any interest in those topics as he now finds himself with both realized and unrealized losses. From a bigger picture, the market sentiment seems very similar to 2000 with risk appetites vanishing. While we are not investing in CDs, we think 2000 marked an ideal entry point for value equities.

PORTFOLIO UPDATE*8

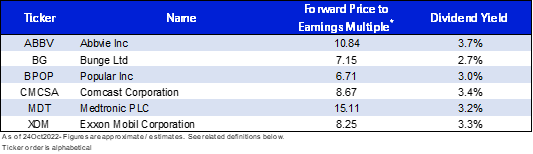

As we canvas the opportunity set for investment ideas, we observe many companies with multiples at what we view is a discount to the overall market that maintain robust profit margins. As we deploy capital, we expect to be opportunistic in upgrading our long portfolio adding to our highest-conviction ideas. In our opinion, our long book has many examples of companies already exhibiting attractive valuations. Below we show 2022 Forward Price to Earnings (P/E) multiples and Dividend Yield of some of our core long positions:

We believe larger cap companies with multiple divisions will be exploring strategic alternatives to unlock value. Recently, we initiated a position in General Electric Co (GE). GE has been in decline for almost two decades and was formerly an iconic American company that at one time held the title of the largest market capitalization in the US stock market. GE plans to split itself into three companies, with GE HealthCare anticipated to be spun-off in early 2023. The company expects this to be followed by GE Vernova, its portfolio of energy businesses, in early 2024. Following the planned spin-offs, GE Aerospace will remain as an aviation-focused company9. We think that as GE is re-sized and singularly purposed the new companies will have highly motivated management teams that will be able to invest and deploy capital without the limitations of its parent company distractions. We expect to be long-term holders of GE as it re-creates and re-brands itself over the next several years.

"There are plenty of reasons why a company might choose to unload or otherwise separate itself from the fortunes of the business to be spun-off. There is really only one reason to pay attention when they do; you can make a pile of money investing in spin-offs." - Joel Greenblatt

"Spin-offs of divisions or parts of companies into separate, freestanding entities…often result in astoundingly lucrative investments” - Peter Lynch

Conversely, there continues to be many securities that we think are ideal short candidates given what we view as current overvaluation. On the short side of the book, we have been increasing our exposure to the “size” factor as we believe flows out of expensive large cap stocks may deflate rich multiples of mega cap stocks; we also continue to be negative on the semiconductor space, due to concerns over international trade relations and the overall economic environment. We think semiconductor stocks tend to perform poorly in recessionary environments. We currently maintain short positions in Nvidia Corp (NVDA) and Broadcom Inc (AVGO), which boast market capitalizations of over $300B and $175B respectively and provide what we think is exposure to the global economy.

View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend.

FINAL THOUGHTS

We hope our investor partners enjoy our monthly perspectives. We are finding many compelling ideas both long and short and we look forward to continuing our dialogue in the weeks and months ahead.

"

I make a living supposedly forecasting changes in the economic environment and the financial markets. With the caveat that I have been doing this 45 years and between the pandemic and the war and the crazy policy response in the United States and worldwide, this is the hardest environment I’ve ever encountered to try and have any confidence in a forecast 6 to 12 months ahead.” – Stanley Druckenmiller

*Definitions: Earnings per Share Estimate is a company’s expected future annual earnings per share, as estimated by professional analysts. Forward Price to Earnings Multiple is the ratio for valuing a company that measures current share price divided by its forecasted earnings per share.

1 The S&P 500 Index includes 500 leading companies and covers approximately 80% of the available market capitalization. The S&P 500 Dividend Yield is the estimated sum of all dividends paid by the index’s stocks in the last 12 months, divided by the index market capitalization as reported by the S&P. The dividend yield does not represent or predict the performance of the Fund. Indexes are unmanaged and it is not possible to invest in an index.

2 The 30-day SEC yield is calculated from the 30 days ending on the last day of the previous month. This figure approximates the yield an investor would receive in a year, assuming that each bond in the portfolio is held until maturity. View the 30 day SEC yield here.

3Source: @SquawkCNBC, Sep 9, 2022

4Source: https://www.nytimes.com/, Oct 22, 2021

5Source: https://www.reuters.com/, Oct 21, 2022

6Source: https://www.bloomberg.com/, Sep 28, 2022

7The S&P 500 Growth Index is a market capitalization weighted index. All the stocks in the underlying parent index are allocated into value or growth. Stocks that do not have pure value or pure growth characteristics have their market caps distributed between the value & growth indices. The NASDAQ Composite Index is a broad-based capitalization-weighted index of stocks in all three NASDAQ tiers: Global Select, Global Market and Capital Market. The index was developed with a base level of 100 as of February 5, 1971. The Ball Metaverse Index is designed to track one of the largest and most valuable socio-economic technological transformations of the coming decades: the Metaverse. The Index is managed by an Expert Council which maps and weights thousands of public companies to seven categories enabling Metaverse technologies and businesses, each weighted by their projected share of Metaverse-related revenues. The BUZZ NextGen AI US Sentiment Leaders Index identifies the 75 most bullish large cap US equities based on investment insights derived from the vast content generated across online platforms. The data is filtered through an analytics model which utilizes Natural Language Processing algorithms and Artificial Intelligence applications. Constituent weights are based on a proprietary scoring model. Source: Bloomberg. Indexes are unmanaged and it is not possible to invest in an index.

8View LBAY top 10 holdings here. Holdings are subject to change. Characteristics and metrics of the companies shown are for the underlying securities in the fund’s portfolio and do not represent or predict the performance of the fund. There is no guarantee that a company will pay or continually increase its dividend. Section Source: Bloomberg unless otherwise noted.

9Source: https://www.ge.com/

10Stanley Druckenmiller quote Source: https://www.youtube.com/, Sep 13, 2022

Opinions expressed are subject to change at any time, are not guaranteed, and should not be considered investment advice.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in REITs, the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to MLPs may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

BDCs generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner

Leatherback Asset Management, Foreside Fund Services, and Tidal ETF Services are not affiliated.

Before investing you should carefully consider the Fund's investment objectives, risks, charges and expenses. This and other information is in the prospectus. A prospectus may be obtained by clicking here. Please read the prospectus carefully before you invest.

“Long” and “short” are investment terms used to describe ownership of securities. To buy securities is to “go long.” The opposite of going long is “selling short.” Short selling is an advanced trading strategy that involves selling a borrowed security. Short sellers make a profit if the price of the security goes down and they are able to buy the security at a lower amount than the price at which they sold the security short.

Since the Funds are actively managed they do not seek to replicate the performance of a specified index. The Funds therefore may have higher portfolio turnover and trading costs than index-based funds.

LBAY Risks: Investing involves risk, including the loss of principal. As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund; and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

The Fund uses short sales and derivatives (options), both of which may involve substantial risk. The loss on a short sale is in principle unlimited since there is no upward limit on the price of a shorted asset. The potential loss from a derivative may be greater than the amount invested due to counter-party default; illiquidity; or other factors. The Fund may hold illiquid assets which may cause a loss if the Fund is unable to sell an asset at a beneficial time or price.

Through its investments in real estate investment trusts (REITs), the Fund is subject to the risks of investing in the real estate market, including decreases in property revenues, increases in interest rates, increases in property taxes and operating expenses, legal and regulatory changes, a lack of credit or capital, defaults by borrowers or tenants, environmental problems and natural disasters.

The Fund’s exposure to master limited parterships (MLPs) may subject the Fund to greater volatility than investments in traditional securities. The value of MLPs and MLP based exchange traded funds and notes may be affected by changes in overall market movements, commodity index volatility, changes in interest rates, or sectors affecting a particular industry or commodity, such as drought, floods, weather, livestock disease, embargoes, tariffs, and international economic, political and regulatory developments.

Business Development Companies (BDCs) generally invest in debt securities that are not rated by a credit rating agency and are considered below investment grade quality (“junk bonds”). Little public information generally exists for the type of companies in which a BDC may invest and, therefore, there is a risk that the Fund may not be able to make a fully informed evaluation of the BDC and its portfolio of investments.

The Fund is classified as “non-diversified” and may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly concentrated in certain issuers.

Foreside Fund Services, LLC, Distributor

Tidal ETF Services, Launch and Structure Partner